August 31, 2017

Fans of economic policy are used to the old “night is day,” “down is up,” approach to economic policy. After all, much of the media are worried about robots taking all the jobs even as the data from the Bureau of Labor Statistics show that productivity growth (the rate at which robots are taking jobs) is at a record slow pace.

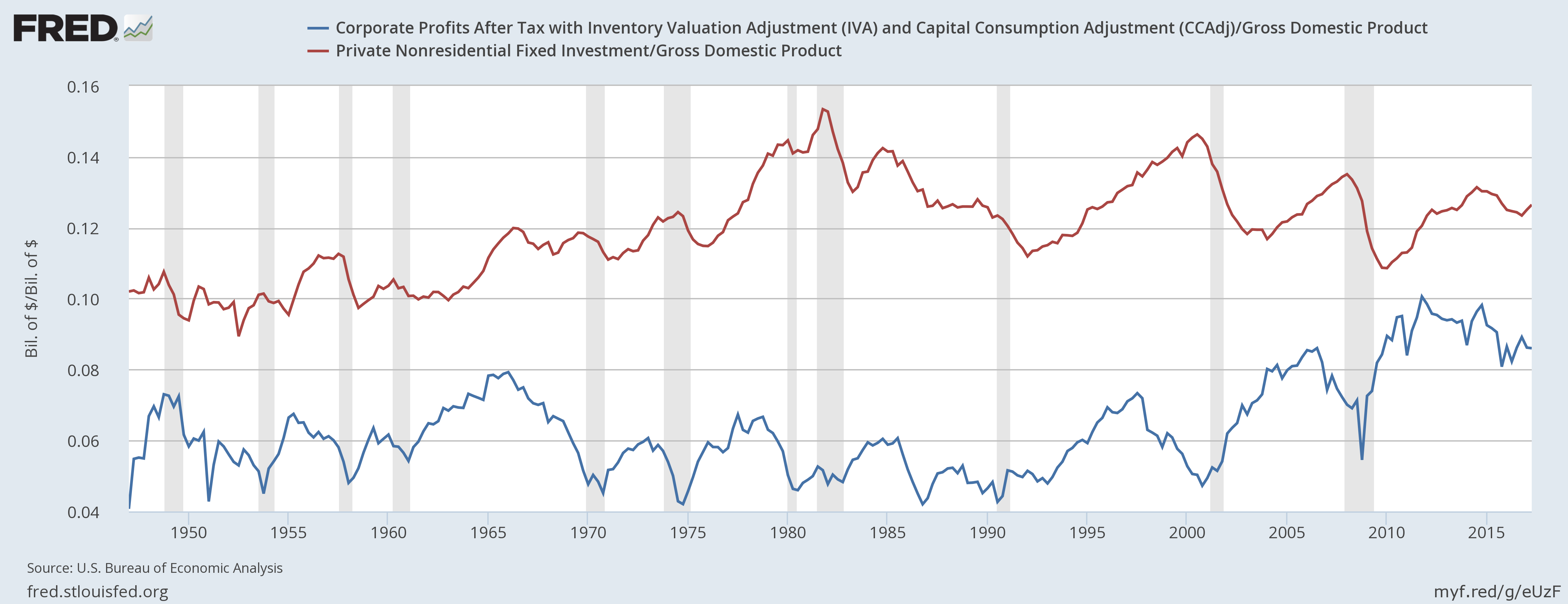

That’s why it is hardly surprising to hear the argument being taken seriously that reducing corporate taxes will lead to more investment and thereby greater wage growth in the future. The data from the last seventy years show there is no relationship between aggregate profits and investment.

As can be seen, there is no evidence that higher corporate profits are associated with an increase in investment. In fact, the peak investment share of GDP was reached in the early 1980s when the after-tax profit share was near its post war low. Investment hit a second peak in 2000, even as the profit share was falling through the second half of the decade. The profit share rose sharply in the 2000s, even as the investment share stagnated. In short, you need a pretty good imagination to look at this data and think that increasing after-tax profits will somehow cause firms to invest more.

Having said this, there is a good argument for reforming the tax code in a way the reduces the opportunities for gaming. The tax avoidance industry is both an enormous waste and an important source of inequality. The resources spent on avoiding taxes, in the form of lawyers, accountants, and corporate engineering, are a complete waste from an economic standpoint. Also running tax avoidance scams allows some people to get very rich. The private equity industry is to a large extent a tax avoidance scam.

So it would be a big gain for the country if the tax code could be restructured in a way that eliminates most of the opportunities for gaming. As I have written before, my preferred approach is requiring companies to turn over a percentage of their stock in the form of non-voting shares, which would be treated exactly like voting shares in terms of dividends and buybacks. This would make it impossible for companies to cheat the government unless it was also cheating its stockholders.

Anyhow, that my preferred route, but it’s probably too simple to get anywhere.

Comments