March 06, 2012

March 6, 2012 (Latin America Data Byte)

By Rebecca Ray

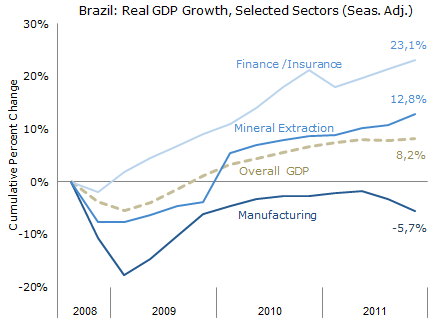

Over the last five years, GDP growth has averaged 4.2 percent per year, while manufacturing has averaged just 1.8 percent growth annually.

GDP growth slowed dramatically in 2011, falling from 7.5 percent growth in 2010 to 2.7 percent last year. In the fourth quarter, it grew by just 1.4 percent on an annualized basis.[1] Mineral extraction and finance led fourth-quarter growth among sectors, with annualized growth rates of 7.3 and 5.9 percent, respectively. Manufacturing was nearly flat over the year, but fell at a 9.5 percent annualized rate in the most recent quarter.[2][2]

Overall GDP Growth

Brazil’s GDP grew at a 1.4 percent annual rate in the fourth quarter of 2011. This is an improvement over the third quarter, when GDP fell at an annual rate of 0.3 percent. For the year, 2011 saw GDP grow 2.7 percent over 2010 levels, less than half of its 2010 growth rate of 7.5 percent.

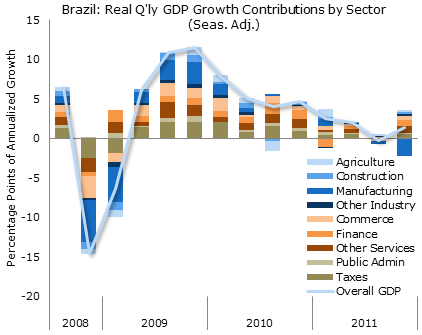

GDP by Industry

GDP growth in the fourth quarter was divided fairly evenly among industries, with one exception: manufacturing, which shrank at a 9.5 percent annualized rate. It was the only sector to decline in the quarter, taking 2.2 percentage points off of overall quarterly GDP growth. Over all of 2011, it has remained flat, growing just 0.1 percent over its 2010 level. But since June it has seen two quarters of consecutive negative growth and fallen to 5.7 percent below its pre-recession peak of 2008.

On the positive side, the fastest-growing sector was mineral extraction, which grew at 7.3 percent annual rate in the fourth quarter. It has grown 3.8 percent over the last year and is now 12.8 percent above its 2008 level. The sector with the best cumulative performance since the recession has been finance and insurance, which is now 23.1 percent above its pre-recession peak. This is a continuation of a long-term trend toward finance and away from manufacturing: over the last five years, overall GDP growth has averaged 4.2 percent per year, while the finance and insurance sector has averaged 9.8 percent and manufacturing has averaged just 1.8 percent growth annually.

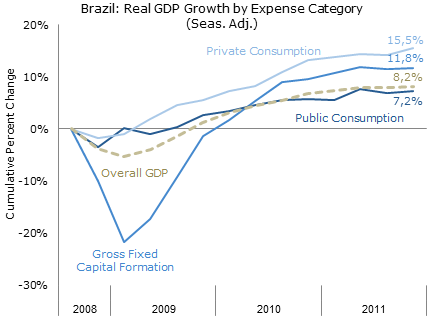

GDP by Type of Demand

Growth continues to be led by private consumption, which grew at an annualized 4.5 percent rate in the fourth quarter and at a 5.4 percent rate for the entire year. In contrast, government spending grew only 1.9 percent for the year, and slowed to a 1.6 percent annual rate in the fourth quarter. Government spending grew at a faster rate than the overall economy during and immediately after the recession, but has since slowed considerably. Gross fixed capital formation, which fell by over 20 percent during the recession, has since recovered to over 10 percent above its pre-recession levels. It grew by 4.7 percent in 2011, although the fourth quarter saw much slower growth of just 0.7 percent, annualized.

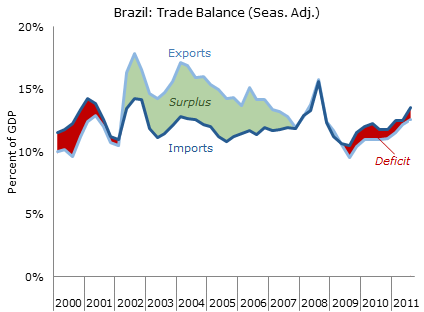

Brazil’s imports continue to grow more quickly than exports. This has been the case for four of the last five years. While the previous business cycle was characterized by trade surpluses, every quarter since mid-2009 has seen deficits. This is not unexpected given that Brazil’s economy has been growing more quickly than the economies of its export market countries. Nonetheless, it may hurt Brazil’s prospects for growth in the present business cycle.

[1] All data is from IBGE.

[2] All seasonal adjustments performed via the US Census Department X-12 Arima.