June 10, 2013

Earlier this month, the Movement Advancement Project, Human Rights Campaign, and Center for American Progress released “A Broken Bargain: Discrimination, Fewer Benefits and More Taxes for LGBTQ+ Workers,” a thorough examination of the unique economic hardships faced by many LGBTQ+ workers in the United States. According to the authors, inadequate legal protections and exclusionary family policies weaken job security and lead to lower compensation for LGBTQ+ workers, especially transgender workers.

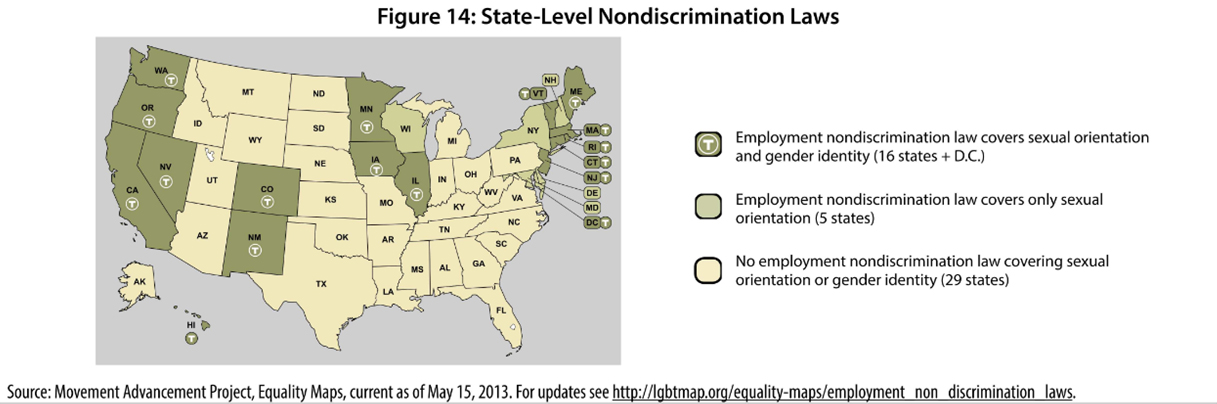

Complete with heartbreaking personal testimonies, the report provides ample statistical evidence to show systemic employment discrimination based on sexual orientation and gender identity. Federal protection against these forms of employment discrimination—stemming from Title VII of the Civil Rights Act—is limited in scope, while state-level nondiscrimination laws vary greatly from state to state. This leaves an estimated 4.3 million LGBTQ+ people vulnerable. As the authors report, only 16 states and the District of Columbia prohibit employment discrimination based on gender expression and gender identity, while 21 states and the District of Columbia protect against discrimination based on sexual orientation. Twenty-nine states offer no protections whatsoever. The following map illustrates this inconsistency.

Click for a larger version

An interactive version of the map, available on the Movement Advancement Project website, allows users to view sub-state non-discrimination policies as well.

Other sources of economic hardship for LGBTQ+ people and their families include tax policies and employer benefits that favor families headed by married heterosexual couples. Same-sex couples (married or not) cannot benefit from joint tax filing, the child tax deduction or childcare expense tax credit for the non-dependent child of a spouse, or Social Security survivor and spousal benefits. Tenuous legal ties to partners and non-dependent children mean that employer-provided benefits such as retirement plans and health care coverage disparately benefit same-sex-headed families. Employer-provided healthcare plans often deny coverage to transgender workers for routine preventative and transition-related health services. These and other practices amount to higher effective taxation and lower benefits for LGBTQ+ workers and their families.