November 19, 2015

CEPR senior economist Eileen Appelbaum spoke about private equity’s leveraged buyout strategies and their effects on American companies and workers at a Capitol Hill briefing on Tuesday titled, “Hedge Funds and Private Equity: Transferring Wealth Up.”

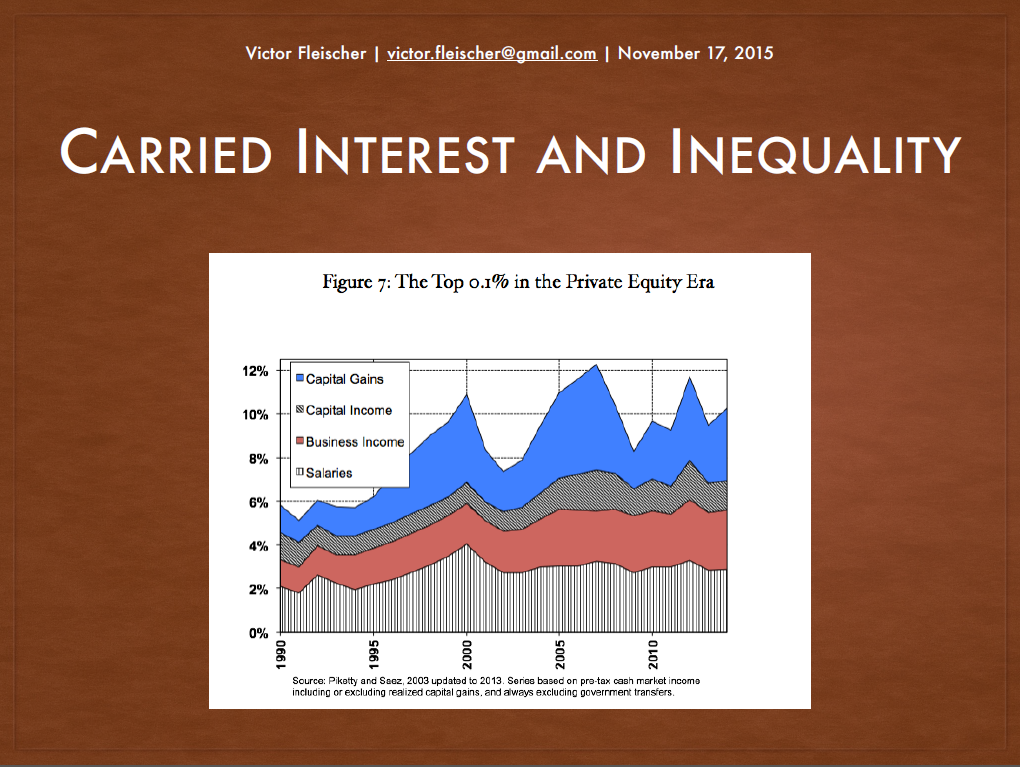

Senator Tammy Baldwin (D-WI), Representative Nydia Velazquez (D-NY), and Senator Al Franken (D-MN) were the keynote speakers. The Senators spoke mainly about the current hot topic of the carried interest tax loophole, which is mostly used by private equity and hedge fund managers. Congresswoman Velazquez discussed the need for more hedge fund transparency, especially in light of the fiscal situation in Puerto Rico.

Click the images below to watch a video of the event, as well as to view the presentations of Eileen and one of her fellow panelists, Victor Fleischer (columnist for The New York Times).

Video:

Slideshows:

Other panelists included David Wood, Director of Initiative for Responsible Investment at the Kennedy School at Harvard, who talked about the concerns of pension trustees about private equity investments, and Eric LeCompte, Executive Director of the Jubilee USA Network, who spoke about how hedge funds in particular are affecting efforts to relieve poverty around the world. The event co-sponsors were Americans for Financial Reform, the AFL-CIO, and the American Federation of Teachers.