February 06, 2017

When people pay their insurance premiums every year, they are hoping that those premiums will cover future expenses. Specifically, that their health insurance companies will cover their bills if they fall ill, their car insurance companies will cover their bills if they get into an accident, etc. While any one individual may pay more or less in premiums than they receive in benefits, the insured population as a whole should generally break even.

However, there is one avenue through which the entire insured population can lose out: overhead costs. Higher overhead costs leave consumers paying more in premiums even when they aren’t receiving more in benefits. In this sense, insurance companies with high overhead costs are similar to expensive middlemen.

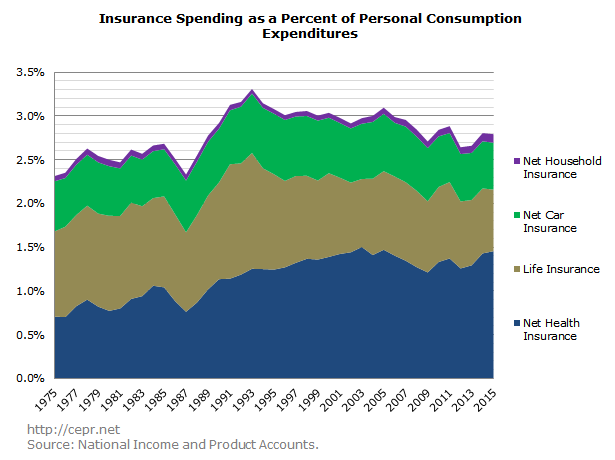

Relative to the size of the economy, Americans are paying more in insurance overhead than they did forty years ago. The figure below shows consumer spending on “net insurance” – overhead costs for insurance companies – from 1975 to 2015 for the four major types of insurance. (Because we don’t have a measure of “net insurance” for life insurance companies, total costs are used as a proxy.)

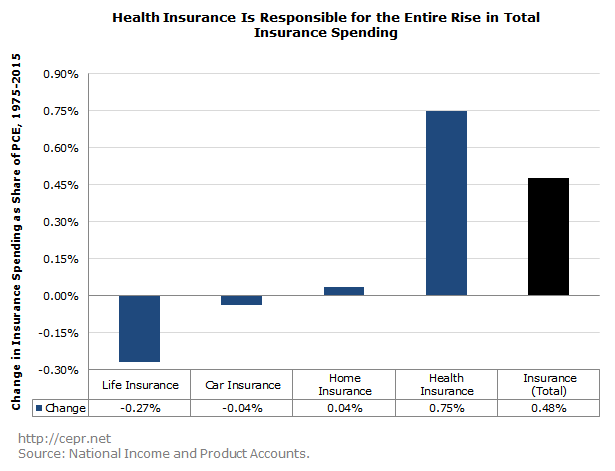

Overhead costs for most types of insurance rose gradually between 1975 and 1993. During that time, “net insurance” costs rose from 2.31 to 3.31 percent of total consumer spending. Since then, overhead costs have generally been declining – except among health insurance companies. The bar graph below displays changes in net insurance spending as a percentage of Americans’ personal consumption expenditures (PCE) from 1975 to 2015. Spending on life insurance has declined, and spending on car insurance and home insurance has been flat. Health insurance companies, on the other hand, are taking an additional 0.75 percentage point of Americans’ pay; this means that, compared to 1975, Americans are spending more of their incomes on insurance middlemen.

It’s worth asking why health insurance companies haven’t been able to achieve the same efficiency gains as other types of insurance companies. Part of this is undoubtedly due to the more general rise in medical spending: even if overhead costs stayed flat as a percentage of health insurance companies’ overall budgets, the mere augmentation of those budgets would cause the absolute amount of overhead spending to increase.

However, it’s also true that overhead costs have increased as a share of company budgets. According to the Centers for Medicare & Medicaid Services, in 1970, overhead was just 9.0 percent of health insurance companies’ total expenses. Overhead peaked at 14.4 percent of total spending in 2003, but hasn’t come down dramatically since then. In recent years, health insurance companies have typically spent more than 12 percent of their budgets on overhead, over a third higher than the rate from 1970.

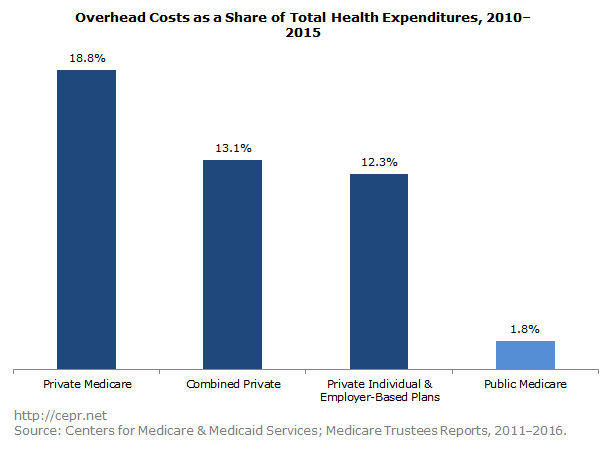

The same cannot be said of public health insurance programs such as Medicare, Medicaid, the Children’s Health Insurance Program, and the Veteran’s Health Administration. This is partially due to the fact that public programs aren’t trying to make profits, but this factor is usually overstated – in fact, the average profit margin for private health insurance companies is just 3.2 percent. A second aspect is the significantly higher marketing costs incurred by insurance companies. Finally, before Obamacare went into effect, a third factor was screening: insurance companies spent large sums vetting insurance applicants to determine if they should be covered, while public programs accepted all eligible applicants regardless of their health status. (Obamacare banned insurance companies from denying insurance to children with pre-existing conditions beginning September 2010 and extended this provision to the entire population in 2014.) The figure below shows that overhead costs under different types of private health insurance plans – employer-based plans, individual plans, and the private insurance aspect of Medicare – are much greater than overhead costs under the public part of Medicare.

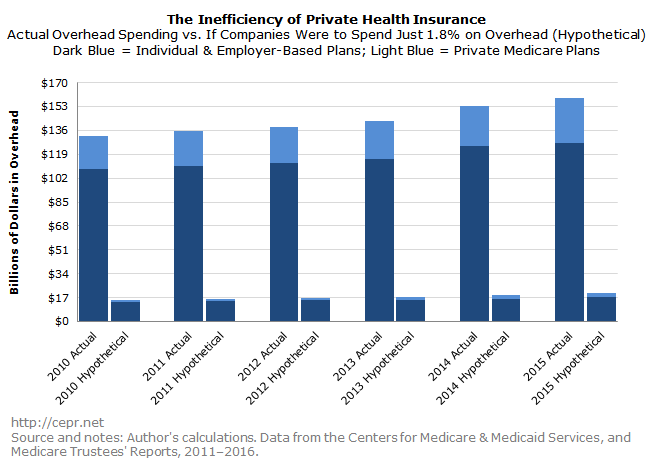

It’s worth asking how much the general public would save if private insurance companies could reach the same level of efficiency achieved by public programs. The table below shows overhead spending among private health insurance companies (in nominal dollars) for six of the last seven years. (Data are not currently available for 2016.) Over this time period, overhead spending has averaged $143 billion per year. If the private sector could reach Medicare’s level of efficiency, overhead spending would fall to less than $20 billion, saving the American people roughly $100 billion per year.

Private health insurance companies spend far more on overhead than government programs do; moreover, private health insurance companies have let these costs soar even as private companies for other types of insurance have managed to rein in or reduce their overhead costs. While waste in government is rightly a target of conservatives, much larger amounts of waste by private health care insurers receives little attention.