September 07, 2011

September 7, 2011 (Latin America Data Byte)

By Rebecca Ray

Manufacturing and commerce lost some of their first-quarter gains, while the petroleum and construction sectors saw improvement.

Venezuela’s second-quarter GDP report shows a decline of 2.5 percent (annualized), on a seasonally adjusted basis, from the first quarter, largely because the first quarter was revised significantly upward [1]. The decline was led by manufacturing and by commerce and repair, both of which shrank after double-digit growth in the first quarter, and by rising imports, which grew at their fastest rate in a year. However, headline GDP has still grown 2.5 percent over the last four quarters combined.

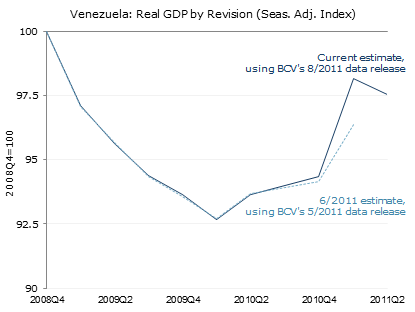

Headline GDP

Venezuela’s latest GDP report included a large upward revision to first-quarter data. Seasonally-adjusted quarterly growth was revised from 9.6 to 17.2 percent, annualized [2]. For the second quarter, GDP is down from the revised first-quarter levels, with annualized growth of negative 2.5 percent. Over the last four quarters, GDP has grown 2.5 percent; this four-quarter growth is the rate published by the Central Bank (BCV) and most frequently cited in the press.

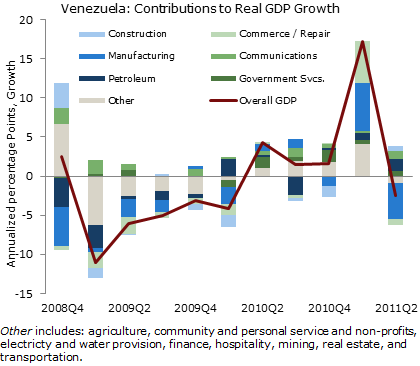

By sector: Manufacturing and Commerce Led Upward in Q1, Lead Downward Now

As the chart below illustrates, first quarter GDP growth was driven by manufacturing and by commerce and repair, both of which saw annualized growth greater than 20 percent. In the second quarter, both of these sectors contracted, bringing down overall GDP growth with them. Together, these sectors added 11.6 percentage points to first-quarter growth; they subtracted 5.5 percentage points of growth from second-quarter GDP. Manufacturing shrank much more than commerce and repair, falling at a 15 percent annualized rate compared to a four percent annualized decline for commerce and repair. After these sectors’ remarkable first-quarter growth, some contraction is to be expected; both sectors are still well above their levels from two quarters ago. Commerce has averaged 14 percent annual growth over the last two quarters, and has grown seven percent over the last four quarters combined. Manufacturing has averaged three percent annual growth over the last two quarters, and grown one percent over the last year.

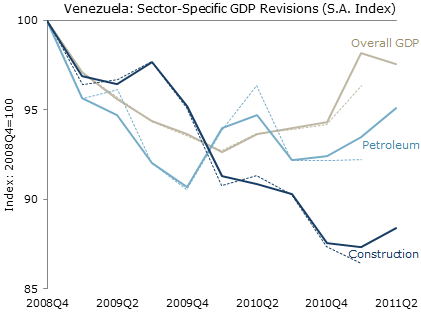

The industries most affected by the first-quarter revisions were petroleum and construction, both of which saw improvements with the new data. Construction, originally reported to have declined at a four percent annual rate in the first quarter, saw that quarter’s decline reduced to just one percent annually. In the second quarter, the sector saw its first growth since 2009, expanding at a five percent annualized rate. It is still two percent below its level from one year ago, and 12 percent below its pre-recession peak. Petroleum’s first-quarter growth was also revised upward, from nearly flat to a five percent annualized rate. It accelerated in the second quarter, growing at a seven percent annual rate. Despite this improvement, the sector has grown less than one percent over the last four quarters, because of a steep decline in the third quarter of last year. It is currently five percent below its pre-recession peak.

Note: Dashed lines correspond to estimates based on BCV’s May 2011 data release. Solid lines correspond to current estimates, based on BCV’s August 2011 data release.

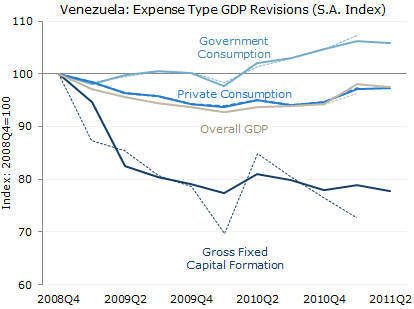

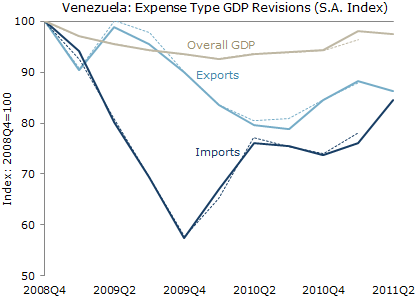

By Expense Type: Large Revisions to Investment and Imports

Among domestic sources of demand, only private consumption rose in the second quarter, and even that growth was meager: one percent on an annualized basis. Since the recovery began in the second quarter of 2010, it has grown by three percent. Government consumption was basically flat in the second quarter, falling at a one percent annual rate, after seeing its first-quarter growth revised downward from ten to six percent, annualized. Still, over the last four quarters it has grown by four percent, and is now six percent above its 2008 level. Finally, the steep decline initially reported for gross fixed capital formation in the first quarter was revised to an increase: from negative 18 to positive five percent growth on an annualized basis. The sector weakened again in the second quarter, however, shrinking at a six percent annual rate. Over the last four quarters, it has fallen by four percent.

Note: Dashed lines correspond to estimates based on BCV’s May 2011 data release. Solid lines correspond to current estimates, based on BCV’s August 2011 data release.

The trade balance worsened, with imports accelerating and exports falling after two quarters of strong growth. (Some 95 percent of exports are oil; the decline in exports here is therefore mostly a decline in the (real) volume of oil and oil products exported, not a decline in oil prices). Exports fell at a nine percent annualized rate, to 14 percent below their pre-recession levels. Because of strong growth in previous quarters, though, they have climbed by eight percent over the last year. Imports saw their first-quarter growth rate fall by nearly half in the revisions, from 24 to 14 percent, annualized. However, in the second quarter they shot up at a 52 percent annualized rate. They are now 15 percent below their pre-recession peak level, having expanded by 12 percent over the last four quarters.

Note: Dashed lines correspond to estimates based on BCV’s May 2011 data release. Solid lines correspond to current estimates, based on BCV’s August 2011 data release.

In sum, a small portion of the first quarter’s gains were reversed in the second quarter, due to declines in manufacturing and commerce, rising imports and falling exports. It will bear watching in future releases whether exports, almost all petroleum, recover, and whether the large first-quarter progress in manufacturing and commerce was an anomaly; or if growth will return to these sectors. It is also worth noting that government consumption has made a significant contribution to the economic recovery until the second quarter; and that the government’s plans for expanding housing have possibly just begun to show up in the construction data. It is likely that the economy’s growth over the next year will depend largely on how much the government decides to spend during this period.

————

[1] The source for all data and figures is the Banco Central de Venezuela.

[2]. A note on seasonal adjustment: in the past, we have presented two methods of seasonal adjustment: a simple adjustment of headline GDP, and the sum of seasonally adjusted industry components. Because of the large industry-level revisions in this release, we rely on seasonally-adjusted headline GDP for our estimates here.