October 10, 2012

Politicians, especially those who want to cut programs like Social Security and Medicare, are fond of telling people that our children and grandchildren will pay the national debt. That one may sell well with focus groups, but it is complete nonsense. Unfortunately, Eduardo Porter repeats this line in his column today.

A moment’s reflection shows why the debt is not a measure of inter-generational equity. At some point everyone alive today will be dead. At that point, the bonds that comprise the debt will be held entirely by our children or grandchildren. The debt will be an asset for the members of future generations that hold these bonds. This can raise distributional issues within a generation. For example, if Bill Gates’ grandchildren own the entire U.S. debt there will be important within generation distributional consequences, however this says nothing about inter-generational distribution.

There is the issue of foreign ownership of the debt, but this is an issue of the trade deficit, not the budget deficit. If the country continues to run large trade deficits, then foreigners will continue to accumulate large amounts of U.S. assets, including government debt, even if we had balanced budgets. The key issue with the trade deficit is the over-valued dollar. In this respect, both candidates have effectively committed the country to large trade deficits by indicating that they will try to maintain the over-valuation of the dollar (a.k.a. “the strong dollar”).

As a generational matter, we pass a whole economy, society and environment to our children. Unless we have given them a really bad education, they would be crazy to opt for a government with a lower national debt in exchange for a weaker economy, a worse infrastructure or more damaged environment. As a practical matter, the sharp upturn in productivity growth in 1995 has virtually assured our children and grandchildren that they will enjoy far higher living standards than anything we could have done by way of lower deficits (and thereby boosting investment) had productivity growth remained at its much slower pre-1995 rate. (The fact that longstanding deficit hawks like Peter Peterson never acknowledge the impact of this uptick on productivity growth suggests that their agenda has little to do with the living standards of future generations.)

The column also contrasts the money paid out in Social Security and Medicare benefits to the money paid out for programs helping the young. While some may like to pit the old against the young, it is also possible to contrast payments to the wealthy to the young. We pay out hundreds of billions of dollars of interest on government debt each year, much of which goes to some of the wealthiest people in the country. These wealthy people surely don’t need the money.

Of course the wealthy paid for the government bonds they own, so they have a strong argument that they should get the interest. Similarly, retirees paid for their Social Security benefits. In addition, the government will save almost no money by taking away the Social Security benefits of the Warren Buffetts and the Bill Gates of the world. They are too few of them and they don’t get large checks. To have any substantial savings it would be necessary to cut benefits for retirees with incomes of around $40,000 a year.

While the government does pay out far more for Medicare than workers paid in taxes, the distributional issue here is with doctors, drug companies and other providers. We pay more than twice as much per person for our health care than people in other wealthy countries even though we have nothing obvious to show for this in terms of outcome. The reason is that we pay our providers far more for the same services. If we want to crack down on inequities here we would make bring pay for doctors and other providers in line with payments in other wealthy countries. It is bizarre to imply that we have done seniors some great favor because we make our doctors rich treating them.

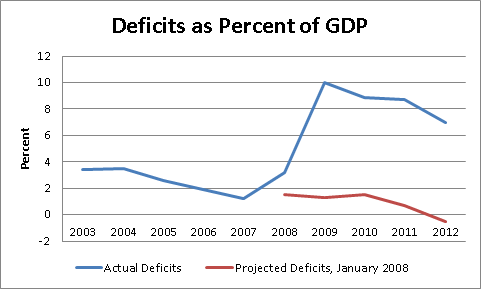

Finally, it is important to note that the large deficits of recent years are entirely the result of the economic slump that followed the collapse of the housing bubble. This is easy to see by comparing the deficit projections from the Congressional Budget Office from January 2008, before the impact of the housing crash was recognized, with actual deficits.

Source: Congressional Budget Office.

There were no major new programs created in 2008 or 2009 nor were there permanent cuts in taxes put in place. The explosion of the deficit was either directly the result of the economy’s collapse (e.g. lower taxes and higher transfers like unemployment benefits) or temporary measures intended to counteract the downturn, like the payroll tax cut. Implying that large deficits have been a chronic problem is just wrong.

Comments