Seriously, they probably don’t want readers to walk away with that impression, but that is the implication of the piece they did complaining about people working multiple jobs. The piece told readers:

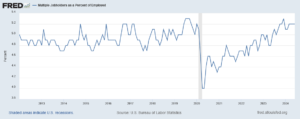

“A record number of Americans worked more than one job last year, and multiple-job holders as a percentage of the total workforce recently matched the highest share since 2019. That was largely driven by women, who worked multiple jobs at the highest rate since the 1990s in December.”

Multiple job holding is not necessarily a sign of a bad labor market. The share of multiple jobholders peaked before the pandemic in 2019 when the recovery was at its peak. Furthermore, as the article itself notes, people might hold multiple jobs because of increased opportunities, not economic hardship.

For example, 36 percent of multiple job holders report that they do telework. The opportunity to do telework was much more limited before the pandemic. It is likely that many of these multiple job holders would not be working at multiple jobs if they didn’t have the opportunity to work from home.

The piece does find people who report experiencing economic hardship, but in an economy with 160 million workers, there will also be millions experiencing economic hardship. For some reason, Bloomberg has chosen to seek these people out and highlight their situations.

By contrast, millions of people work in hotels and restaurants. Their average hourly wage has risen by almost 31 percent since the start of the pandemic in 2020, far above the 21 percent increase in prices over this period. Surely many of these people are doing considerably better now than in 2020.

For some reason, Bloomberg and most of the rest of the media have decided to ignore these and other moderate-income workers who have seen their situation substantially improve as a result of the strong labor market of the last two and half years.

Seriously, they probably don’t want readers to walk away with that impression, but that is the implication of the piece they did complaining about people working multiple jobs. The piece told readers:

“A record number of Americans worked more than one job last year, and multiple-job holders as a percentage of the total workforce recently matched the highest share since 2019. That was largely driven by women, who worked multiple jobs at the highest rate since the 1990s in December.”

Multiple job holding is not necessarily a sign of a bad labor market. The share of multiple jobholders peaked before the pandemic in 2019 when the recovery was at its peak. Furthermore, as the article itself notes, people might hold multiple jobs because of increased opportunities, not economic hardship.

For example, 36 percent of multiple job holders report that they do telework. The opportunity to do telework was much more limited before the pandemic. It is likely that many of these multiple job holders would not be working at multiple jobs if they didn’t have the opportunity to work from home.

The piece does find people who report experiencing economic hardship, but in an economy with 160 million workers, there will also be millions experiencing economic hardship. For some reason, Bloomberg has chosen to seek these people out and highlight their situations.

By contrast, millions of people work in hotels and restaurants. Their average hourly wage has risen by almost 31 percent since the start of the pandemic in 2020, far above the 21 percent increase in prices over this period. Surely many of these people are doing considerably better now than in 2020.

For some reason, Bloomberg and most of the rest of the media have decided to ignore these and other moderate-income workers who have seen their situation substantially improve as a result of the strong labor market of the last two and half years.

Read More Leer más Join the discussion Participa en la discusión

I don’t have the answer to that question, but if I was CNN’s pollster I would be concerned. They just did a poll on households’ financial situation and the responses they got are clearly out-of-line with a number of different independent data sources.

For example, the poll found that 35 percent of people said that they had to take on extra work to make ends meet. But the Bureau of Labor Statistics’ survey of households finds that just 5.1 percent of workers report being multiple job holders, the same as the year-round average for 2019 before the pandemic.

Furthermore, 36 percent of the people who report that they have multiple jobs also say they do telework. This indicates that many of the multiple jobholders have a second job because they have increased opportunities, not just out of necessity.

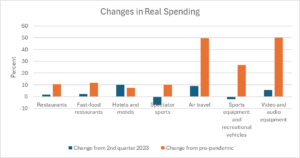

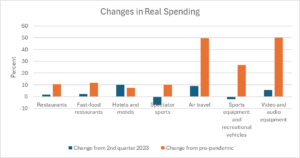

Unfortunately, this is not the only item in CNN’s poll that seems radically out of line with independent data sources. The poll finds that 69 percent of people cut back on extras and entertainment. But, this contradicts Commerce Department data showing that real (inflation-adjusted) spending at restaurants is up by 1.7 percent from last year and 10.7 percent from the fourth quarter of 2019 before the pandemic. Real spending at fast-food restaurants is up 2.1 percent from last year and 11.8 percent from before the pandemic.

Real spending at hotels and motels is up by 9.9 percent from last year and 7.4 percent from before the pandemic. Real spending at spectator sports is up 9.9 percent from before the pandemic, although it’s down 7.0 percent from last year. (There was a big jump in the second quarter of 2023 for some reason.) Spending on air travel is up 9.0 percent from last year and 49.5 percent from before the pandemic. This also fits travel data from the Transportation Security Authority (TSA) showing record numbers of people going through security checks.

Purchases of sports equipment and recreational vehicles is up 26.7 percent from before the pandemic, although down by 2.2 percent from last year. Spending on video and audio equipment is up by 50.2 percent from before the pandemic and 5.5 percent from last year.

These are areas that we might think of as “extras,” but in every case real spending is well above the pre-pandemic level and in almost every case considerably above the year-ago level. If the 69 percent of the people in the CNN poll who report cutting back are accurately describing their behavior, then the other 31 percent must be spending like crazy.

Source: Bureau of Economic Analysis and author’s calculations.

CNN also reports that 41 percent of respondents say they have cut back their driving. By contrast, the Commerce Department data show that gas consumption is up by 1.8 percent from before the pandemic, although it is down 0.5 percent from last year. Before making too much of that year-over-year drop off consider that there were 1.1 million electric vehicles sold last year, 2.0 million hybrids, and 0.2 plugin hybrids. This means we could have seen more cars on the road with less gas being used, which is basically what the American Automobile Association (AAA) found in its surveys.

We know that we have huge a problem with inequality in this country, but that doesn’t seem to offer much of an explanation. After all, do we think it’s plausible that the rich suddenly started eating much more fast food since the pandemic and driving everywhere around the country?

We know that jobs are relatively plentiful. The unemployment rate has risen somewhat in the last 14 months, but it is still unusually low at 4.1 percent. Furthermore, wage increases at the bottom end of the wage distribution have far outpaced inflation, so this is not consistent with low-income workers feeling especially stressed right now.

To be clear, we know that tens of millions of people are struggling to make ends meet and that many are falling short, going hungry and/or losing housing. But this was the story before the pandemic also, when most people were positive about the economy.

In short, the data on people’s spending patterns does not seem consistent with what people are telling CNN in its poll. I’ll let CNN figure out why there would be this discrepancy, but I am inclined to trust the data on retail sales, which come from a variety of different sources, and are confirmed by independent sources like TSA and AAA, than the answers CNN got in its poll.

I don’t have the answer to that question, but if I was CNN’s pollster I would be concerned. They just did a poll on households’ financial situation and the responses they got are clearly out-of-line with a number of different independent data sources.

For example, the poll found that 35 percent of people said that they had to take on extra work to make ends meet. But the Bureau of Labor Statistics’ survey of households finds that just 5.1 percent of workers report being multiple job holders, the same as the year-round average for 2019 before the pandemic.

Furthermore, 36 percent of the people who report that they have multiple jobs also say they do telework. This indicates that many of the multiple jobholders have a second job because they have increased opportunities, not just out of necessity.

Unfortunately, this is not the only item in CNN’s poll that seems radically out of line with independent data sources. The poll finds that 69 percent of people cut back on extras and entertainment. But, this contradicts Commerce Department data showing that real (inflation-adjusted) spending at restaurants is up by 1.7 percent from last year and 10.7 percent from the fourth quarter of 2019 before the pandemic. Real spending at fast-food restaurants is up 2.1 percent from last year and 11.8 percent from before the pandemic.

Real spending at hotels and motels is up by 9.9 percent from last year and 7.4 percent from before the pandemic. Real spending at spectator sports is up 9.9 percent from before the pandemic, although it’s down 7.0 percent from last year. (There was a big jump in the second quarter of 2023 for some reason.) Spending on air travel is up 9.0 percent from last year and 49.5 percent from before the pandemic. This also fits travel data from the Transportation Security Authority (TSA) showing record numbers of people going through security checks.

Purchases of sports equipment and recreational vehicles is up 26.7 percent from before the pandemic, although down by 2.2 percent from last year. Spending on video and audio equipment is up by 50.2 percent from before the pandemic and 5.5 percent from last year.

These are areas that we might think of as “extras,” but in every case real spending is well above the pre-pandemic level and in almost every case considerably above the year-ago level. If the 69 percent of the people in the CNN poll who report cutting back are accurately describing their behavior, then the other 31 percent must be spending like crazy.

Source: Bureau of Economic Analysis and author’s calculations.

CNN also reports that 41 percent of respondents say they have cut back their driving. By contrast, the Commerce Department data show that gas consumption is up by 1.8 percent from before the pandemic, although it is down 0.5 percent from last year. Before making too much of that year-over-year drop off consider that there were 1.1 million electric vehicles sold last year, 2.0 million hybrids, and 0.2 plugin hybrids. This means we could have seen more cars on the road with less gas being used, which is basically what the American Automobile Association (AAA) found in its surveys.

We know that we have huge a problem with inequality in this country, but that doesn’t seem to offer much of an explanation. After all, do we think it’s plausible that the rich suddenly started eating much more fast food since the pandemic and driving everywhere around the country?

We know that jobs are relatively plentiful. The unemployment rate has risen somewhat in the last 14 months, but it is still unusually low at 4.1 percent. Furthermore, wage increases at the bottom end of the wage distribution have far outpaced inflation, so this is not consistent with low-income workers feeling especially stressed right now.

To be clear, we know that tens of millions of people are struggling to make ends meet and that many are falling short, going hungry and/or losing housing. But this was the story before the pandemic also, when most people were positive about the economy.

In short, the data on people’s spending patterns does not seem consistent with what people are telling CNN in its poll. I’ll let CNN figure out why there would be this discrepancy, but I am inclined to trust the data on retail sales, which come from a variety of different sources, and are confirmed by independent sources like TSA and AAA, than the answers CNN got in its poll.

Read More Leer más Join the discussion Participa en la discusión

This really is kind of mind-boggling. It had a nice piece pointing out that it has now been 15 years since the last hike in the federal minimum wage. This is the longest stretch since the federal minimum wage was first established in 1938. The real value of the minimum wage has been allowed to fall to its 1949 level. These points are well-taken as is its noting of research showing that higher minimum wages do not cost jobs.

But when it came to an explanation as to why the minimum wage has not been raised it told listeners:

“But the idea keeps going nowhere. Why? The short answer is congressional gridlock.”

Huh? Almost every Democrat in Congress has voted for higher minimum wages over this period. Almost every Republican has voted against minimum wage hikes. There is a pretty clear story here, the minimum wage has not been increased because Republicans oppose a higher minimum wage.

Is there some reason Marketplace Radio couldn’t be honest with its listeners? The Republicans can presumably defend their position, but why is the show hiding it? Democrats support a higher minimum wage, Republicans oppose one. When it comes to explaining why it hasn’t been raised for 15 years, it is that simple.

This really is kind of mind-boggling. It had a nice piece pointing out that it has now been 15 years since the last hike in the federal minimum wage. This is the longest stretch since the federal minimum wage was first established in 1938. The real value of the minimum wage has been allowed to fall to its 1949 level. These points are well-taken as is its noting of research showing that higher minimum wages do not cost jobs.

But when it came to an explanation as to why the minimum wage has not been raised it told listeners:

“But the idea keeps going nowhere. Why? The short answer is congressional gridlock.”

Huh? Almost every Democrat in Congress has voted for higher minimum wages over this period. Almost every Republican has voted against minimum wage hikes. There is a pretty clear story here, the minimum wage has not been increased because Republicans oppose a higher minimum wage.

Is there some reason Marketplace Radio couldn’t be honest with its listeners? The Republicans can presumably defend their position, but why is the show hiding it? Democrats support a higher minimum wage, Republicans oppose one. When it comes to explaining why it hasn’t been raised for 15 years, it is that simple.

Read More Leer más Join the discussion Participa en la discusión

I’m not generally one to get teary-eyed over politicians. They mostly spend their careers trying to appease people with money and power. That’s how you get ahead in American politics. (There are exceptions, most obviously people like Bernie Sanders and Elizabeth Warren.) But they also are the ones who at the end of the day make policy and these policies make a huge difference in the lives of real people, for better or worse.

And once you get to the very top, it is hard to let go. President Biden really deserves our thanks for recognizing that he could best serve the party, the country, and the world by passing the torch.

Biden has much to show for his term in office to date. On the domestic side, he was the most impactful president in more than half a century. First and foremost, he pushed through his big recovery package just after taking office.

Job growth had slowed to a crawl in the last three months of the Trump administration. It would have taken five and half years to get back the lost jobs at the pace the economy was creating them from November of 2020 to January of 2021. Instead, we got the jobs back in a year and half under Biden.

The rapid job growth quickly got us back to full employment, with the unemployment rate reaching 4.0 percent by the end of the year. It fell further in 2022 and remained very low through 2023, although it has crept up modestly in recent months.

We saw the predicted benefits of full employment. The labor market improved most for the most disadvantaged groups in the labor market. Blacks, Black teens, and Hispanics all saw their unemployment rates fall to record lows.

The wage growth was most rapid at the lower end of the wage ladder, reversing the pattern of the last forty-five years. The gap in median wages between white workers and Black workers fell to the lowest level on record.

The strong labor market gave workers unprecedented ability to leave jobs they didn’t like. They could leave boring and dangerous jobs, or ones with few opportunities for advancement, and seek out better ones. As a result, workers reported the highest level of job satisfaction on record.

It’s also important to remind people that Biden really does deserve credit for the recovery package. He pushed it through Congress with only a couple votes to spare in the House and no room in the Senate.

After getting the recovery package through, Biden managed to pass three major bills with long-term impact. First, he passed a bipartisan infrastructure bill, which allocated funding not just for traditional infrastructure, but also replacing lead pipes for drinking water, extended high-speed Internet access, and established a national charging station network for electric vehicles.

He then passed the CHIPS Act which appropriated money for research and provided subsidies for building cutting edge semiconductors in the United States. The case for reshoring manufacturing can be overstated, but it is important to ensure secure supplies of essential economic inputs, and semiconductors certainly fit in that category.

Most importantly, Biden got the Inflation Reduction Act (IRA) passed. This bill was primarily about kick-starting the green transition with subsidies for wind and solar energy, as well as electric vehicles.

While it is easy to say that the bill is inadequate given the size of the problem, the point is that it is a huge foot in the door. Going forward, it will not just be environmentalist-types pushing for money for the transition, it will be major businesses looking for profits. We can be fairly confident that, apart from a complete political catastrophe, we will see considerable pressure for further support for a green transition.

The IRA also included more funding for I.R.S. enforcement. This is a big deal since rich people were increasingly seeing taxes as optional. The I.R.S. now has cops on the beat to crack down on billionaire tax cheats.

Biden also pushed a pro-labor agenda, appointing people to the National Labor Relations Board who take seriously the responsibility to protect workers’ right to organize. He was also the first president ever to join a union picket line when he marched with UAW strikers last fall.

He also appointed people to the Federal Trade Commission and the Justice Department who take anti-trust policy seriously. Mergers and acquisitions that might have gone through unquestioned under prior administrations were scrutinized, and in some cases blocked.

We have seen a half-century of anti-labor policies and neglect of meaningful anti-trust enforcement. This cannot be reversed in a single four-year term, but Biden made a very good start.

I have written much on Biden’s record on domestic policy and will write more, but it was very impactful. He has much to show for three and half years in office with the barest congressional majority in the first two years and a split Congress in the second half of his term. He will be stepping down at the top of his game.

Getting back to Biden’s decision to step down, it is difficult to imagine how hard it is for these people to give up the power and status they have struggled for a lifetime to gain. To take a more pernicious example of a politician whose career in some ways paralleled Biden’s, Richard Nixon rose from a modest background to become vice-president, before narrowly losing the presidential race in 1960 to John F. Kennedy. He then lost a race for governor in California and seemed to declare the end of his political career, saying in an angry press conference “you won’t have Dick Nixon to kick around anymore.”

Remarkably, he came back to get the Republican nomination and then slip into the White House in 1968 in another close election. Being obsessed with power, he spied on his opponents and engaged in various types of illegal activity to contain opposition. (The current SCOTUS would probably say it was all legal.)

Anyhow, things began to unravel for Nixon when the Watergate break-in was uncovered and then people began to talk. The line got traced back to the White House and the key evidence was to be found on Nixon’s own tapes. When the Supreme Court ordered them released and the public saw them, it was clear that Nixon was in on the coverup from the beginning and everything he had said about the case was a lie.

In spite of this, Nixon was prepared to tough it out. The Republicans in Congress realized this was a disaster for the party. They sent a delegation of three senior senators to see Nixon, led by Barry Goldwater, the 1964 nominee and godfather of the modern conservative movement.

They told Nixon the score, trying politely to urge him to step down. Since Nixon’s impeachment in the House was already a foregone conclusion, he began to inquire about whether he could get the one-third of the Senate needed to keep him in office.

According to their account, Nixon turned to them and said something to the effect of “let’s see, I have you three” and then started to come up with other potential names. Goldwater shut this down by telling Nixon that he didn’t know that he could count on him. Nixon resigned the next day.

Anyhow, President Biden obviously cares far more about the country and the party, but the Nixon episode shows how hard it can be for people to step aside once they have attained the pinnacle of power. We really do owe him a big debt of gratitude.

I will add one more point to put this in context. Can anyone imagine Donald Trump doing the same thing?

I’m not generally one to get teary-eyed over politicians. They mostly spend their careers trying to appease people with money and power. That’s how you get ahead in American politics. (There are exceptions, most obviously people like Bernie Sanders and Elizabeth Warren.) But they also are the ones who at the end of the day make policy and these policies make a huge difference in the lives of real people, for better or worse.

And once you get to the very top, it is hard to let go. President Biden really deserves our thanks for recognizing that he could best serve the party, the country, and the world by passing the torch.

Biden has much to show for his term in office to date. On the domestic side, he was the most impactful president in more than half a century. First and foremost, he pushed through his big recovery package just after taking office.

Job growth had slowed to a crawl in the last three months of the Trump administration. It would have taken five and half years to get back the lost jobs at the pace the economy was creating them from November of 2020 to January of 2021. Instead, we got the jobs back in a year and half under Biden.

The rapid job growth quickly got us back to full employment, with the unemployment rate reaching 4.0 percent by the end of the year. It fell further in 2022 and remained very low through 2023, although it has crept up modestly in recent months.

We saw the predicted benefits of full employment. The labor market improved most for the most disadvantaged groups in the labor market. Blacks, Black teens, and Hispanics all saw their unemployment rates fall to record lows.

The wage growth was most rapid at the lower end of the wage ladder, reversing the pattern of the last forty-five years. The gap in median wages between white workers and Black workers fell to the lowest level on record.

The strong labor market gave workers unprecedented ability to leave jobs they didn’t like. They could leave boring and dangerous jobs, or ones with few opportunities for advancement, and seek out better ones. As a result, workers reported the highest level of job satisfaction on record.

It’s also important to remind people that Biden really does deserve credit for the recovery package. He pushed it through Congress with only a couple votes to spare in the House and no room in the Senate.

After getting the recovery package through, Biden managed to pass three major bills with long-term impact. First, he passed a bipartisan infrastructure bill, which allocated funding not just for traditional infrastructure, but also replacing lead pipes for drinking water, extended high-speed Internet access, and established a national charging station network for electric vehicles.

He then passed the CHIPS Act which appropriated money for research and provided subsidies for building cutting edge semiconductors in the United States. The case for reshoring manufacturing can be overstated, but it is important to ensure secure supplies of essential economic inputs, and semiconductors certainly fit in that category.

Most importantly, Biden got the Inflation Reduction Act (IRA) passed. This bill was primarily about kick-starting the green transition with subsidies for wind and solar energy, as well as electric vehicles.

While it is easy to say that the bill is inadequate given the size of the problem, the point is that it is a huge foot in the door. Going forward, it will not just be environmentalist-types pushing for money for the transition, it will be major businesses looking for profits. We can be fairly confident that, apart from a complete political catastrophe, we will see considerable pressure for further support for a green transition.

The IRA also included more funding for I.R.S. enforcement. This is a big deal since rich people were increasingly seeing taxes as optional. The I.R.S. now has cops on the beat to crack down on billionaire tax cheats.

Biden also pushed a pro-labor agenda, appointing people to the National Labor Relations Board who take seriously the responsibility to protect workers’ right to organize. He was also the first president ever to join a union picket line when he marched with UAW strikers last fall.

He also appointed people to the Federal Trade Commission and the Justice Department who take anti-trust policy seriously. Mergers and acquisitions that might have gone through unquestioned under prior administrations were scrutinized, and in some cases blocked.

We have seen a half-century of anti-labor policies and neglect of meaningful anti-trust enforcement. This cannot be reversed in a single four-year term, but Biden made a very good start.

I have written much on Biden’s record on domestic policy and will write more, but it was very impactful. He has much to show for three and half years in office with the barest congressional majority in the first two years and a split Congress in the second half of his term. He will be stepping down at the top of his game.

Getting back to Biden’s decision to step down, it is difficult to imagine how hard it is for these people to give up the power and status they have struggled for a lifetime to gain. To take a more pernicious example of a politician whose career in some ways paralleled Biden’s, Richard Nixon rose from a modest background to become vice-president, before narrowly losing the presidential race in 1960 to John F. Kennedy. He then lost a race for governor in California and seemed to declare the end of his political career, saying in an angry press conference “you won’t have Dick Nixon to kick around anymore.”

Remarkably, he came back to get the Republican nomination and then slip into the White House in 1968 in another close election. Being obsessed with power, he spied on his opponents and engaged in various types of illegal activity to contain opposition. (The current SCOTUS would probably say it was all legal.)

Anyhow, things began to unravel for Nixon when the Watergate break-in was uncovered and then people began to talk. The line got traced back to the White House and the key evidence was to be found on Nixon’s own tapes. When the Supreme Court ordered them released and the public saw them, it was clear that Nixon was in on the coverup from the beginning and everything he had said about the case was a lie.

In spite of this, Nixon was prepared to tough it out. The Republicans in Congress realized this was a disaster for the party. They sent a delegation of three senior senators to see Nixon, led by Barry Goldwater, the 1964 nominee and godfather of the modern conservative movement.

They told Nixon the score, trying politely to urge him to step down. Since Nixon’s impeachment in the House was already a foregone conclusion, he began to inquire about whether he could get the one-third of the Senate needed to keep him in office.

According to their account, Nixon turned to them and said something to the effect of “let’s see, I have you three” and then started to come up with other potential names. Goldwater shut this down by telling Nixon that he didn’t know that he could count on him. Nixon resigned the next day.

Anyhow, President Biden obviously cares far more about the country and the party, but the Nixon episode shows how hard it can be for people to step aside once they have attained the pinnacle of power. We really do owe him a big debt of gratitude.

I will add one more point to put this in context. Can anyone imagine Donald Trump doing the same thing?

Read More Leer más Join the discussion Participa en la discusión

The Washington Post published a scorecard that evaluated the economy’s performance during the Trump and Biden administrations. While it has much useful information, there are a few areas where it needs some additional clarification.

The first and most important issue is the comparison of real wage growth under Trump and Biden. The problem is that the Post chart uses the average hourly real wage in January 2021, when Trump left office, as the basis for the comparisons.

This is problematic since the wage for that month is hugely distorted by the fact millions of low-paid workers were still unemployed as a result of the pandemic. For example, employment in the low-paying leisure and hospitality sector was 4.1 million lower in January 2021 than it had been in February 2020 before the pandemic hit. This has the effect of raising the average wage in the same way that getting rid of the shortest person in the room increases the average height.

We are interested in the change in real wages that workers actually see, not increases due to changes in the composition of the workforce. There is no perfect way to adjust for this composition issue, but a crude correction would be to treat February 2020 as the endpoint for the Trump years and the start point for the Biden years. This treatment would also be consistent with some of the other graphs, where the pandemic period is pulled out and not attributed to either president.

With this adjustment, the growth in the average real wage for production and nonsupervisory workers during the Trump years was 3.6 percent compared to 3.1 percent in the Biden years. That compares to the growth shown in the Post chart of 7.6 percent in the Trump years and 0.2 percent in the Biden years.

Home Buying

Another area that deserves some comment is its treatment of home buying. The piece compares the monthly cost of buying the median house, relative to median income, under Trump and Biden. This cost was far lower under Trump than Biden primarily because mortgage rates were far lower but also because there was a sharp rise in house prices in the first year of the Biden administration.

While this comparison is accurate, it is primarily relevant for potential first-time homebuyers. That is a relatively small group compared to the 86 million households who already own a home.

This group hugely benefitted by the low interest rates from the start of the pandemic until the Fed began raising rates in March 2022. More than 14 million people refinanced their mortgages at lower interest rates. On average, these households are saving more than $2,000 a year on interest payments.

It is also worth noting that, while the run-up in house prices is an unambiguous negative from the standpoint of first-time buyers, it can be a positive for existing homeowners. Higher house prices will help them if they move to a lower-cost area, downsize, become renters, or opt to get a reverse mortgage to help support their retirement.

Employment to Population Ratios

The piece includes a section showing overall employment to population ratios (EPOP), as well as the ratios for Black and women workers. This sort of comparison is distorted by the fact that the huge baby boom cohort is moving into its 60s and 70s, ages where they are far more likely to be retired.

A better comparison would look at the EPOPs for prime-age workers, ages 25 to 54. By this measure, the Biden administration looks considerably better than the Trump administration. For 2023, the year-round average for the overall prime-age EPOP was 80.7 percent, compared to just 80.0 percent in 2019, the best year under Trump.

For prime-age women workers the year-round average EPOP was 75.1 percent in 2023 compared to 73.7 percent in 2019. For prime-age Black workers the year-round average was 77.6 percent in 2023, 1.6 percentage points higher than the 2019 peak of 76.0 percent under Trump.

There is much useful material in the Post’s charts, but these are areas where some additional context would have been helpful.

The Washington Post published a scorecard that evaluated the economy’s performance during the Trump and Biden administrations. While it has much useful information, there are a few areas where it needs some additional clarification.

The first and most important issue is the comparison of real wage growth under Trump and Biden. The problem is that the Post chart uses the average hourly real wage in January 2021, when Trump left office, as the basis for the comparisons.

This is problematic since the wage for that month is hugely distorted by the fact millions of low-paid workers were still unemployed as a result of the pandemic. For example, employment in the low-paying leisure and hospitality sector was 4.1 million lower in January 2021 than it had been in February 2020 before the pandemic hit. This has the effect of raising the average wage in the same way that getting rid of the shortest person in the room increases the average height.

We are interested in the change in real wages that workers actually see, not increases due to changes in the composition of the workforce. There is no perfect way to adjust for this composition issue, but a crude correction would be to treat February 2020 as the endpoint for the Trump years and the start point for the Biden years. This treatment would also be consistent with some of the other graphs, where the pandemic period is pulled out and not attributed to either president.

With this adjustment, the growth in the average real wage for production and nonsupervisory workers during the Trump years was 3.6 percent compared to 3.1 percent in the Biden years. That compares to the growth shown in the Post chart of 7.6 percent in the Trump years and 0.2 percent in the Biden years.

Home Buying

Another area that deserves some comment is its treatment of home buying. The piece compares the monthly cost of buying the median house, relative to median income, under Trump and Biden. This cost was far lower under Trump than Biden primarily because mortgage rates were far lower but also because there was a sharp rise in house prices in the first year of the Biden administration.

While this comparison is accurate, it is primarily relevant for potential first-time homebuyers. That is a relatively small group compared to the 86 million households who already own a home.

This group hugely benefitted by the low interest rates from the start of the pandemic until the Fed began raising rates in March 2022. More than 14 million people refinanced their mortgages at lower interest rates. On average, these households are saving more than $2,000 a year on interest payments.

It is also worth noting that, while the run-up in house prices is an unambiguous negative from the standpoint of first-time buyers, it can be a positive for existing homeowners. Higher house prices will help them if they move to a lower-cost area, downsize, become renters, or opt to get a reverse mortgage to help support their retirement.

Employment to Population Ratios

The piece includes a section showing overall employment to population ratios (EPOP), as well as the ratios for Black and women workers. This sort of comparison is distorted by the fact that the huge baby boom cohort is moving into its 60s and 70s, ages where they are far more likely to be retired.

A better comparison would look at the EPOPs for prime-age workers, ages 25 to 54. By this measure, the Biden administration looks considerably better than the Trump administration. For 2023, the year-round average for the overall prime-age EPOP was 80.7 percent, compared to just 80.0 percent in 2019, the best year under Trump.

For prime-age women workers the year-round average EPOP was 75.1 percent in 2023 compared to 73.7 percent in 2019. For prime-age Black workers the year-round average was 77.6 percent in 2023, 1.6 percentage points higher than the 2019 peak of 76.0 percent under Trump.

There is much useful material in the Post’s charts, but these are areas where some additional context would have been helpful.

Read More Leer más Join the discussion Participa en la discusión

Leading media outlets like The New York Times, The Atlantic, and The New Yorker have about as much concern for intellectual consistency as TikTok videos. In very serious and somber tones they will warn the rest of us about a major problem and then in the next issue, or the next article, present a story that is 180 degrees at odds without ever realizing the contradiction.

My favorite example of this “Which way is up?” problem is the simultaneous concern expressed that AI will eliminate all the jobs and that declining birth rates will lead to worker shortages. We got a taste of the former in an NYT article about efforts by OpenAI’s CEO Sam Altman to promote guaranteed income programs.

According to the piece, Altman and other tech types who share his views, are concerned that AI will lead to mass unemployment and further increase the gap between rich and poor. While this concern is voiced frequently in elite publications it is 180 degrees at odds with almost everything else they write.

First and foremost, if AI is going to lead to massive job loss there is zero reason to worry that declining birth rates will lead to a shrinking workforce. If we don’t have any jobs, why would we need more workers?

This issue also comes up with immigration. We are regularly told that we need immigrants because we have a shortage of native-born workers. But if AI is going to eliminate all the jobs, we won’t need large-scale immigration. To be clear, there are other reasons we might want immigration, but we can’t believe both. AI will lead to a massive loss of jobs and we also need immigrants to do our work.

The idea that AI will lead to massive job loss also means that productivity growth, and therefore economic growth, will be far more rapid than current projections indicate. The latest projections from the Congressional Budget Office show productivity growth averaging a bit over 1.6 percent annually over the next decade.

It’s not clear how fast the AI-will-kill-all-the-jobs gang expect productivity to grow, but we had productivity growth averaging just under 3.0 percent annually from 1947 to 1973, and we still maintained low rates of unemployment through most of this period. Clearly, they must envision considerably faster productivity growth, perhaps 5 or 6 percent annually.

If we had productivity growth anywhere near this fast, many other widely hyped concerns would quickly disappear. For example, the widely touted national debt would look pretty inconsequential if we could sustain anywhere near 5.0 percent productivity growth over a decade. (That would be the case even with 3.0 percent productivity growth.)

Also, the projected shortfalls in Social Security would be eliminated if average wages rose anywhere near as fast as productivity, as has largely been the case in the past. (It’s true that the median wage has not kept pace with productivity growth, but that is mostly due to the upward redistribution of wealth to highly paid workers like CEOs, Wall Street types, and well-placed STEM workers, not a failure of average wages to keep pace with productivity.)

We also would have little reason to be concerned about inflation if we’re seeing the sort of extraordinary productivity gains anticipated by the AI proselytizers. As a first approximation, inflation is equal to wage growth minus productivity growth. If we have productivity growth of 5.0 percent annually, we can have 7.0 percent nominal wage growth and still be at the Fed’s 2.0 percent inflation target. That pace would be more rapid than the peaks we saw in 2021–2022 when we were bouncing back from the pandemic.

In short, if the worldview being hyped by the AI folks in this piece is anywhere close to accurate, many of the concerns expressed in public discussions are completely off the mark. Either the AI gang is wrong or many other people writing in elite publications are wasting their time.

Is There a Case for a Guaranteed Income?

Since people often ask me, I might as well throw in a few words. I find the basic question sort of silly since it rarely is posed in the real-world context of being a question of trade-offs. (This is assuming that the AI gang is wrong in thinking that AI will take all the jobs.) Like many people, I would say that abstractly a guaranteed income would be a good idea, but in a world where millions of parents can’t afford child care, and many have inadequate housing and health care, I would have a hard time arguing that a guaranteed income should be a top priority.

A guaranteed income makes more sense in countries that have more fully developed welfare states. But $1,000 a month, or whatever is picked as the income target, will not pay for people’s health care, food, housing, and their kids’ child care. I would place the priority on ensuring that everyone has access to these necessities.

I’ll also add my other standard line. The massive inequality we see in America today is not simply due to market outcomes, rather it is the result of how we have chosen to structure the market.

The most important issue here is government-granted patent and copyright monopolies. These redistribute over $1 trillion a year from the rest of us to people in a position to benefit from these government-granted monopolies. This is seen most clearly with people like Bill Gates, who might still be working for a living if he couldn’t count on the government arresting people who used Microsoft’s software without his permission. While it is possible to argue for the merits of patent and copyright laws as policies for promoting innovation and creative work, the point is that they are policies, not intrinsic features of the market.

I realize that people who write for elite outlets don’t like to acknowledge the fact that inequality is the result of how we have chosen to structure the market, not the result of the natural workings of the market. This allows them to pontificate about how the winners should best toss a few breadcrumbs to the losers, as the AI gang seems to be doing. It avoids the question of whether we should not have rigged the market in a way to produce such extreme inequality in the first place. (Yes, this is my book, Rigged [it’s free].)

Leading media outlets like The New York Times, The Atlantic, and The New Yorker have about as much concern for intellectual consistency as TikTok videos. In very serious and somber tones they will warn the rest of us about a major problem and then in the next issue, or the next article, present a story that is 180 degrees at odds without ever realizing the contradiction.

My favorite example of this “Which way is up?” problem is the simultaneous concern expressed that AI will eliminate all the jobs and that declining birth rates will lead to worker shortages. We got a taste of the former in an NYT article about efforts by OpenAI’s CEO Sam Altman to promote guaranteed income programs.

According to the piece, Altman and other tech types who share his views, are concerned that AI will lead to mass unemployment and further increase the gap between rich and poor. While this concern is voiced frequently in elite publications it is 180 degrees at odds with almost everything else they write.

First and foremost, if AI is going to lead to massive job loss there is zero reason to worry that declining birth rates will lead to a shrinking workforce. If we don’t have any jobs, why would we need more workers?

This issue also comes up with immigration. We are regularly told that we need immigrants because we have a shortage of native-born workers. But if AI is going to eliminate all the jobs, we won’t need large-scale immigration. To be clear, there are other reasons we might want immigration, but we can’t believe both. AI will lead to a massive loss of jobs and we also need immigrants to do our work.

The idea that AI will lead to massive job loss also means that productivity growth, and therefore economic growth, will be far more rapid than current projections indicate. The latest projections from the Congressional Budget Office show productivity growth averaging a bit over 1.6 percent annually over the next decade.

It’s not clear how fast the AI-will-kill-all-the-jobs gang expect productivity to grow, but we had productivity growth averaging just under 3.0 percent annually from 1947 to 1973, and we still maintained low rates of unemployment through most of this period. Clearly, they must envision considerably faster productivity growth, perhaps 5 or 6 percent annually.

If we had productivity growth anywhere near this fast, many other widely hyped concerns would quickly disappear. For example, the widely touted national debt would look pretty inconsequential if we could sustain anywhere near 5.0 percent productivity growth over a decade. (That would be the case even with 3.0 percent productivity growth.)

Also, the projected shortfalls in Social Security would be eliminated if average wages rose anywhere near as fast as productivity, as has largely been the case in the past. (It’s true that the median wage has not kept pace with productivity growth, but that is mostly due to the upward redistribution of wealth to highly paid workers like CEOs, Wall Street types, and well-placed STEM workers, not a failure of average wages to keep pace with productivity.)

We also would have little reason to be concerned about inflation if we’re seeing the sort of extraordinary productivity gains anticipated by the AI proselytizers. As a first approximation, inflation is equal to wage growth minus productivity growth. If we have productivity growth of 5.0 percent annually, we can have 7.0 percent nominal wage growth and still be at the Fed’s 2.0 percent inflation target. That pace would be more rapid than the peaks we saw in 2021–2022 when we were bouncing back from the pandemic.

In short, if the worldview being hyped by the AI folks in this piece is anywhere close to accurate, many of the concerns expressed in public discussions are completely off the mark. Either the AI gang is wrong or many other people writing in elite publications are wasting their time.

Is There a Case for a Guaranteed Income?

Since people often ask me, I might as well throw in a few words. I find the basic question sort of silly since it rarely is posed in the real-world context of being a question of trade-offs. (This is assuming that the AI gang is wrong in thinking that AI will take all the jobs.) Like many people, I would say that abstractly a guaranteed income would be a good idea, but in a world where millions of parents can’t afford child care, and many have inadequate housing and health care, I would have a hard time arguing that a guaranteed income should be a top priority.

A guaranteed income makes more sense in countries that have more fully developed welfare states. But $1,000 a month, or whatever is picked as the income target, will not pay for people’s health care, food, housing, and their kids’ child care. I would place the priority on ensuring that everyone has access to these necessities.

I’ll also add my other standard line. The massive inequality we see in America today is not simply due to market outcomes, rather it is the result of how we have chosen to structure the market.

The most important issue here is government-granted patent and copyright monopolies. These redistribute over $1 trillion a year from the rest of us to people in a position to benefit from these government-granted monopolies. This is seen most clearly with people like Bill Gates, who might still be working for a living if he couldn’t count on the government arresting people who used Microsoft’s software without his permission. While it is possible to argue for the merits of patent and copyright laws as policies for promoting innovation and creative work, the point is that they are policies, not intrinsic features of the market.

I realize that people who write for elite outlets don’t like to acknowledge the fact that inequality is the result of how we have chosen to structure the market, not the result of the natural workings of the market. This allows them to pontificate about how the winners should best toss a few breadcrumbs to the losers, as the AI gang seems to be doing. It avoids the question of whether we should not have rigged the market in a way to produce such extreme inequality in the first place. (Yes, this is my book, Rigged [it’s free].)

Read More Leer más Join the discussion Participa en la discusión

That is a question that should occur to people who read through the Republican Party’s platform. Not only does the platform promise to extend the 2017 tax cuts, which will potentially put tens of billions of dollars in Elon Musk’s pocket over the next decade, it also promises to “modernize the military.”

“Republicans will ensure our Military is the most modern, lethal and powerful Force in the World. We will invest in cutting- edge research and advanced technologies, including an Iron Dome Missile Defense Shield, support our Troops with higher pay, and get woke Leftwing Democrats fired as soon as possible.”

This looks to be hundreds of billions or even trillions of dollars in additional spending over the next decade. Elon Musk, among others, is likely to be well-situated to get some of the contracts that will be involved in modernizing the military.

It is also important to understand the prospect of a massive increase in military spending in its larger context. We currently are spending roughly $900 billion a year on the military, or a bit more than 3.0 percent of GDP. If we were to expand to the Cold War levels we saw under Reagan, that would take us to $1.8 trillion a year or 6.0 percent of GDP.

In this respect, it is worth noting that the Soviet Union’s economy at its peak was roughly 60 percent of the size of the U.S. economy. China’s economy is already almost 25 percent larger than the U.S. economy and growing considerably more rapidly. This means that if we are getting into a full-fledged arms race, the 1980s Cold War spending may be too conservative.

As far as how much Musk and other military contractors are likely to get out of an increase in spending, it is worth noting that excessive payments and outright fraud are already big problems with military contracting. However, the problem is likely to get considerably worse in a second Trump administration.

There are a number of potential checks on fraud and abuse in place at present. These include the Defense Department’s Inspector General, the Government Accountability Office (GAO), and the Justice Department, which can investigate allegations of fraud.

Donald Trump has said that he wants to remove these sorts of checks on his presidential power. They would all fit into his category of the “deep state.” These people are likely the “woke Leftwing Democrats” who the platform promises to fire as soon as possible.[1]

Trump also has complete authority to direct the Justice Department to ignore allegations of fraud in military contracts. The recent Supreme Court ruling on presidential immunity even stated that a prosecutor could not ask questions as to whether a payment to Trump or his family members, AKA “a bribe”, was a factor in the awarding of a contract. This means there could be quite a windfall in an expanded military budget for well-positioned contractors. (Elon Musk just promised to contribute hundreds of millions of dollars to Trump’s election campaign.)

Matt Yglesias has made a similar point about Trump’s proposal for massive taxes on imports, AKA “tariffs.” Trump would have complete control over the size of these taxes and could increase or decrease them on a whim. This means that if the CEO of a company angered him with a public comment, Trump could hugely increase the taxes imposed on an essential import for this company.

Alternatively, if the CEO were to make a large contribution to Trump’s political action committee or his pocket, Trump could lower the taxes imposed on the company’s imports. And remember, the Supreme Court says no one can ask any questions about Trump’s motives for these actions.

The long and short here is that we always have to worry about corruption in government dealings, however Trump is campaigning on a platform where he is explicitly committed to removing all the potential checks and the Supreme Court has just granted him complete immunity to be as corrupt as he feels like being.

In this context, Elon Musk’s campaign contributions look like to be a very good investment, and very costly for the rest of us.

[1] GAO is a congressional agency, but it is likely that with a Republican trifecta, Congressional leaders would respond to orders from Trump to fire any GAO investigators that were raising questions about contracts he awarded.

That is a question that should occur to people who read through the Republican Party’s platform. Not only does the platform promise to extend the 2017 tax cuts, which will potentially put tens of billions of dollars in Elon Musk’s pocket over the next decade, it also promises to “modernize the military.”

“Republicans will ensure our Military is the most modern, lethal and powerful Force in the World. We will invest in cutting- edge research and advanced technologies, including an Iron Dome Missile Defense Shield, support our Troops with higher pay, and get woke Leftwing Democrats fired as soon as possible.”

This looks to be hundreds of billions or even trillions of dollars in additional spending over the next decade. Elon Musk, among others, is likely to be well-situated to get some of the contracts that will be involved in modernizing the military.

It is also important to understand the prospect of a massive increase in military spending in its larger context. We currently are spending roughly $900 billion a year on the military, or a bit more than 3.0 percent of GDP. If we were to expand to the Cold War levels we saw under Reagan, that would take us to $1.8 trillion a year or 6.0 percent of GDP.

In this respect, it is worth noting that the Soviet Union’s economy at its peak was roughly 60 percent of the size of the U.S. economy. China’s economy is already almost 25 percent larger than the U.S. economy and growing considerably more rapidly. This means that if we are getting into a full-fledged arms race, the 1980s Cold War spending may be too conservative.

As far as how much Musk and other military contractors are likely to get out of an increase in spending, it is worth noting that excessive payments and outright fraud are already big problems with military contracting. However, the problem is likely to get considerably worse in a second Trump administration.

There are a number of potential checks on fraud and abuse in place at present. These include the Defense Department’s Inspector General, the Government Accountability Office (GAO), and the Justice Department, which can investigate allegations of fraud.

Donald Trump has said that he wants to remove these sorts of checks on his presidential power. They would all fit into his category of the “deep state.” These people are likely the “woke Leftwing Democrats” who the platform promises to fire as soon as possible.[1]

Trump also has complete authority to direct the Justice Department to ignore allegations of fraud in military contracts. The recent Supreme Court ruling on presidential immunity even stated that a prosecutor could not ask questions as to whether a payment to Trump or his family members, AKA “a bribe”, was a factor in the awarding of a contract. This means there could be quite a windfall in an expanded military budget for well-positioned contractors. (Elon Musk just promised to contribute hundreds of millions of dollars to Trump’s election campaign.)

Matt Yglesias has made a similar point about Trump’s proposal for massive taxes on imports, AKA “tariffs.” Trump would have complete control over the size of these taxes and could increase or decrease them on a whim. This means that if the CEO of a company angered him with a public comment, Trump could hugely increase the taxes imposed on an essential import for this company.

Alternatively, if the CEO were to make a large contribution to Trump’s political action committee or his pocket, Trump could lower the taxes imposed on the company’s imports. And remember, the Supreme Court says no one can ask any questions about Trump’s motives for these actions.

The long and short here is that we always have to worry about corruption in government dealings, however Trump is campaigning on a platform where he is explicitly committed to removing all the potential checks and the Supreme Court has just granted him complete immunity to be as corrupt as he feels like being.

In this context, Elon Musk’s campaign contributions look like to be a very good investment, and very costly for the rest of us.

[1] GAO is a congressional agency, but it is likely that with a Republican trifecta, Congressional leaders would respond to orders from Trump to fire any GAO investigators that were raising questions about contracts he awarded.

Read More Leer más Join the discussion Participa en la discusión

Federal Reserve Board Chair Jerome Powell has been saying for some time that he needs to see more evidence that inflation is under control before he lowers interest rates. We can never be certain of where the economy is going, so it’s understandable that he remains worried that inflation could reaccelerate.

However, there are risks in the opposite direction as well which Powell has explicitly recognized in the past. He has stated that the Fed has an obligation to maximize employment and said that this part of the Fed’s mandate needs to be taken as seriously as its commitment to price stability. That is why many of us were happy President Biden reappointed him as Fed chair. But he has to act now to show this commitment.

June Jobs

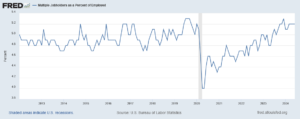

The June jobs report released Friday can hardly be viewed as bad. The establishment survey showed the economy creating 206,000 jobs, while the household survey reported the unemployment rate was 4.1 percent (4.05 percent before rounding). Those topline numbers are healthy by almost any standard, but there is cause for concern on both sides.

On the establishment side, the prior two months’ numbers were revised down by a total of 111,000, which means that the June number was only 95,000 larger than the estimate of jobs from the establishment survey that we were looking at in May. This makes the average job gain for the last three months 177,000. That is a reasonable number given current estimates of potential labor force growth, but certainly not a pace that should give the Fed cause for concern about excessive inflationary pressures.

It’s also worth noting that more than a third (70,000) of the job growth in June was in the government sector, almost entirely at the state and local level. Government jobs substantially lagged behind the private sector in this recovery, so this growth is mostly a catch-up story, but it is likely an anomaly. With many state and local governments now facing shortfalls as COVID funds get depleted, they will not be hiring at anywhere near this pace going forward.

Over the last three months, we have created an average of 146,000 private sector jobs. Again, this is a fine pace, but hardly one that should prompt fears of accelerating inflation.

On the household side, we have been seeing a gradual uptick in the unemployment rate since it bottomed out at 3.4 percent last April. If this trend continues, we will be having a serious issue with unemployment. As it is, we should be able to do better than 4.1 percent. The unemployment rate averaged 3.7 percent in 2019, with no clear evidence of inflationary pressures.

As Chair Powell has noted, higher unemployment disproportionately impacts groups that face discrimination in the labor market. We see this clearly with the unemployment rate for Black workers. This bottomed out at 4.8 percent last April (an all-time low). It now stands at 6.3 percent, an increase of 1.5 percentage points.

Getting the unemployment rate down by another half percentage point will make a noticeable difference in the prospects for disadvantaged groups. It should be an important policy goal.

Other data in the household survey also provide some basis for concern. The share of long-term unemployment (more than 26 weeks) has edged up to 22.2 percent of the unemployed. It had been under 19.0 percent at the start of the year. This indicates more people are having serious problems finding jobs.

Another item showing labor force weakness is the relatively small share of unemployment due to voluntary quits. This share stood at 11.2 percent in June, which was up slightly from 10.8 percent in May. This is very low given the overall unemployment rate. It averaged 13.1 percent in the two years before the pandemic. It peaked at 16.0 percent in September 2022. This indicates that workers don’t feel the sort of confidence about their labor market prospects that we would expect given a 4.1 percent unemployment rate.

The June job report also shows that wage growth has slowed to a level that the Fed should feel comfortable with. The annualized rate for the last three months was just 3.6 percent, only a couple of tenths higher than the average for 2018-2019. The year-over-year rate was 3.9 percent.

Other labor market data show a similar trend. The JOLTS data show the job openings rate falling back from a record high at the start of 2022 to roughly the same level as pre-pandemic peaks. The quit rate has fallen to a level slightly below the peaks of 2018-2019. Unemployment insurance claims and continuing claims, after hitting record lows, are now actually slightly higher as a share of the workforce than before the pandemic.

Non governmental data tell the same story. For example, the Indeed Wage Tracker in April showed that wage growth for new hires averaged just 3.1 percent more than a year ago. This is the same as the rate of increase before the pandemic. Since this measure only looks at new hires, it tends to lead movements in the labor market as a whole. This supports the view that wage growth is likely to continue to slow.

It is also important to remember that the profit share of income has increased by almost 2.0 percentage points since the start of the pandemic. Unless the Fed has the view that any rise in the profit share is permanent, it should be prepared to see wage growth somewhat in excess of what might be a sustainable noninflationary long-term rate in order to restore the wage share at least to its pre-pandemic level. It will have to rise considerably further in order for the wage share to revert to its level at the start of the century.

Inflation Is Near the Fed’s Target

Chair Powell has repeatedly said that the 2.0 percent target was an average, not a ceiling. That should mean that an inflation rate close to 2.0 percent is consistent with the target.

Taking the year-over-year numbers we are still considerably higher than 2.0 percent, but this is mostly a story driven by rent. In the case of the Consumer Price Index (CPI), the year-over-year figure is 3.3 percent, but without shelter, it is just 2.1 percent. With the PCE, year-over-year inflation is 2.6 percent, but without shelter it is less than 1.9 percent.

It is reasonable to pull out shelter since this is driven by leases that were signed 1–2 years ago. The inflation rate for rent on housing units that go on the market is very low and possibly less than zero. The inflation rate for shelter will converge on the rate for new units even if the timing of this convergence is uncertain. But the point is that the Fed can be confident that the direction of inflation in the near-term is lower, going towards the Fed’s target.

We also know that expectations of inflation by many measures are back or nearly back to their pre-pandemic levels. The Atlanta Fed’s measure of business expectations of year-ahead inflation is 2.3 percent, a rate that we saw at several points in 2018–2019. The other regional Feds’ indexes for manufacturers’ expectations of prices paid and prices received also show a return to pre-pandemic rates.

The breakeven inflation rate for five-year inflation-indexed bonds is now just over 2.2 percent, virtually the same as the rate at several points in 2018. Also, it is important to remember that the index used for these bonds is the CPI, which typically has an inflation rate that is 0.2–0.3 percentage points higher than the PCE that the Fed targets. This means that expectations in the bond market are that inflation will be at or perhaps slightly below the rate targeted by the Fed.

The story here is that the risk of an inflationary spiral like what we saw in the 1970s is now near zero. Wage growth has moderated to a pace that is almost the same as what we saw before the pandemic and is likely to slow further. In addition, inflation has been gradually slowing for the last two years and is virtually certain to continue to slow.

The Fed’s Rate Cut Trade-Offs

Much reporting has framed the rate cut decision as one where the Fed has to be worried about being embarrassed by lowering rates too soon and seeing a reacceleration of inflation. The argument is that the Fed erred by waiting too long before raising rates in 2022, which allowed inflation to get higher than if the Fed had been more vigilant. Since the Fed had made this mistake, it doesn’t want to again err on the side of excessive inflation by cutting rates too soon, which would be a major embarrassment.

While that may be the framing of some observers, there is little logic to the argument. The Fed has its dual responsibilities of maintaining low inflation and maximizing employment. If it now errs by needlessly allowing the unemployment rate to continue to rise, it does not somehow even the score. This mistake is not made any better by the fact that it made a mistake in the opposite direction three years ago. The Fed has to try to make the right call now, based on the data it has.

On that front, it seems difficult to maintain that excessive inflation is a greater threat than a weakening labor market. The unemployment rate has risen 0.7 percentage points in the last 14 months. It is now 0.3 percentage points higher than the average we saw in the last two years before the pandemic. That corresponds to another 510,000 people being unemployed who would be employed if we had a stronger labor market. If current trends continue, this figure will rise further over the next year. This should be taken seriously.

There is also the point that high interest rates have put a serious dent in the housing market. Sales of existing homes are down by more than 30 percent from their peaks in 2021 before the Fed started raising rates. As a result, hundreds of thousands of potential first-time buyers are being kept out of the housing market. Millions of homeowners who might otherwise sell their homes are keeping them off the market and being prevented from making moves they want to make.

While rates will not decline to the point where we again see the 3.0 percent mortgages of 2021, it is reasonable to believe that lower rates from the Fed can get the mortgage rate back under 6.0 percent and eventually close to 5.0 percent. That would make a huge difference in the housing market.

High rates are also increasing financial instability. It is unlikely that we will see more failures like the collapse of Silicon Valley Bank in 2023, but banks will be hit in the months and years ahead by the write-down of loans on commercial real estate. Lower rates will make it far easier for them to get through a rash of defaults and bankruptcies in this sector. The housing market and financial stability may not rank as high as maximizing employment and low inflation on the Fed’s priority list, but they are factors it should take into account in setting interest rates.

There are events in the world that could see a reigniting of inflation. The Houthi attacks on shipping in the Red Sea have sent shipping costs soaring, which will be passed on in higher prices. A larger war in the Middle East could take oil offline and send gas prices soaring again. Many other possible disasters could be added to this list.

But these sorts of events are always a risk. The Fed can’t design monetary policy with the idea that it should try to limit inflation in the event some crisis occurs. It needs to respond to the economy that it is seeing at the time. And right now, this economy is arguing for lower rates.

Addendum – June CPI Decline Cements the Case

The CPI fell 0.1 percent in June, the first drop since the shutdown days at the start of the pandemic. The decline was to some extent an anomaly since a sharp drop in energy prices took the overall index into negative territory but inflation in the core index was just 0.1 percent.

The good part of the story is that just about everything in this report seems to be going in the right direction. Slower rental inflation, which we have been predicting based on the rents in marketed units that change hands, is now showing up in the CPI. The rental indexes both rose just 0.3 percent in June.

Inflation in medical services rose just 0.2 percent. New vehicle prices fell by 0.2 percent, used vehicle prices fell 1.5 percent. The index for household furnishings and supplies fell by 0.2 percent. Even the index for veterinarian services, which had been rising rapidly, fell by 0.5 percent in June.

More important than the topline number here is the fact that there is now basically zero evidence of ongoing inflation at an excessive rate. The index excluding shelter has risen just 1.8 percent over the last year. It is definitely time for the Fed to cut rates.

Federal Reserve Board Chair Jerome Powell has been saying for some time that he needs to see more evidence that inflation is under control before he lowers interest rates. We can never be certain of where the economy is going, so it’s understandable that he remains worried that inflation could reaccelerate.

However, there are risks in the opposite direction as well which Powell has explicitly recognized in the past. He has stated that the Fed has an obligation to maximize employment and said that this part of the Fed’s mandate needs to be taken as seriously as its commitment to price stability. That is why many of us were happy President Biden reappointed him as Fed chair. But he has to act now to show this commitment.

June Jobs

The June jobs report released Friday can hardly be viewed as bad. The establishment survey showed the economy creating 206,000 jobs, while the household survey reported the unemployment rate was 4.1 percent (4.05 percent before rounding). Those topline numbers are healthy by almost any standard, but there is cause for concern on both sides.

On the establishment side, the prior two months’ numbers were revised down by a total of 111,000, which means that the June number was only 95,000 larger than the estimate of jobs from the establishment survey that we were looking at in May. This makes the average job gain for the last three months 177,000. That is a reasonable number given current estimates of potential labor force growth, but certainly not a pace that should give the Fed cause for concern about excessive inflationary pressures.

It’s also worth noting that more than a third (70,000) of the job growth in June was in the government sector, almost entirely at the state and local level. Government jobs substantially lagged behind the private sector in this recovery, so this growth is mostly a catch-up story, but it is likely an anomaly. With many state and local governments now facing shortfalls as COVID funds get depleted, they will not be hiring at anywhere near this pace going forward.

Over the last three months, we have created an average of 146,000 private sector jobs. Again, this is a fine pace, but hardly one that should prompt fears of accelerating inflation.

On the household side, we have been seeing a gradual uptick in the unemployment rate since it bottomed out at 3.4 percent last April. If this trend continues, we will be having a serious issue with unemployment. As it is, we should be able to do better than 4.1 percent. The unemployment rate averaged 3.7 percent in 2019, with no clear evidence of inflationary pressures.

As Chair Powell has noted, higher unemployment disproportionately impacts groups that face discrimination in the labor market. We see this clearly with the unemployment rate for Black workers. This bottomed out at 4.8 percent last April (an all-time low). It now stands at 6.3 percent, an increase of 1.5 percentage points.

Getting the unemployment rate down by another half percentage point will make a noticeable difference in the prospects for disadvantaged groups. It should be an important policy goal.

Other data in the household survey also provide some basis for concern. The share of long-term unemployment (more than 26 weeks) has edged up to 22.2 percent of the unemployed. It had been under 19.0 percent at the start of the year. This indicates more people are having serious problems finding jobs.

Another item showing labor force weakness is the relatively small share of unemployment due to voluntary quits. This share stood at 11.2 percent in June, which was up slightly from 10.8 percent in May. This is very low given the overall unemployment rate. It averaged 13.1 percent in the two years before the pandemic. It peaked at 16.0 percent in September 2022. This indicates that workers don’t feel the sort of confidence about their labor market prospects that we would expect given a 4.1 percent unemployment rate.

The June job report also shows that wage growth has slowed to a level that the Fed should feel comfortable with. The annualized rate for the last three months was just 3.6 percent, only a couple of tenths higher than the average for 2018-2019. The year-over-year rate was 3.9 percent.

Other labor market data show a similar trend. The JOLTS data show the job openings rate falling back from a record high at the start of 2022 to roughly the same level as pre-pandemic peaks. The quit rate has fallen to a level slightly below the peaks of 2018-2019. Unemployment insurance claims and continuing claims, after hitting record lows, are now actually slightly higher as a share of the workforce than before the pandemic.

Non governmental data tell the same story. For example, the Indeed Wage Tracker in April showed that wage growth for new hires averaged just 3.1 percent more than a year ago. This is the same as the rate of increase before the pandemic. Since this measure only looks at new hires, it tends to lead movements in the labor market as a whole. This supports the view that wage growth is likely to continue to slow.

It is also important to remember that the profit share of income has increased by almost 2.0 percentage points since the start of the pandemic. Unless the Fed has the view that any rise in the profit share is permanent, it should be prepared to see wage growth somewhat in excess of what might be a sustainable noninflationary long-term rate in order to restore the wage share at least to its pre-pandemic level. It will have to rise considerably further in order for the wage share to revert to its level at the start of the century.

Inflation Is Near the Fed’s Target

Chair Powell has repeatedly said that the 2.0 percent target was an average, not a ceiling. That should mean that an inflation rate close to 2.0 percent is consistent with the target.

Taking the year-over-year numbers we are still considerably higher than 2.0 percent, but this is mostly a story driven by rent. In the case of the Consumer Price Index (CPI), the year-over-year figure is 3.3 percent, but without shelter, it is just 2.1 percent. With the PCE, year-over-year inflation is 2.6 percent, but without shelter it is less than 1.9 percent.