June 09, 2017

Many economists have expressed surprise over the fact that investment has not been stronger in the recovery from the Great Recession, given the high level of corporate profits. The trends in investment and profits over the last half century suggest that they should not be surprised.

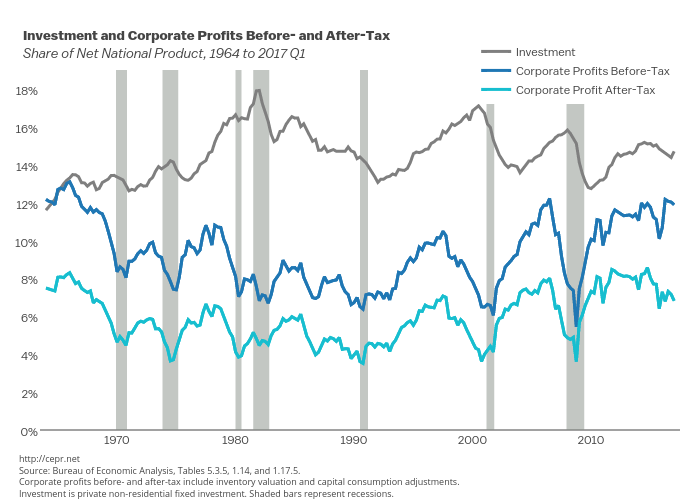

Profit and investment shares of GDP have not moved together over this period. In fact, there is weak negative correlation in shares over this period (-0.3). The figure below shows before- and after-tax shares of profit in net national product (NNP) since 1964.[1] (We use NNP to take account of the fact that the depreciation share of output has increased substantially over this period, which would bias the profit share downward.) It also shows the share of non-residential fixed investment in NNP.

There are several points worth noting about these trends. First, there is not much movement in the non-residential investment share. The table below shows the investment shares of NNP by decade:

| Decade | Investment Shares |

| 1970s | 13.9% |

| 1980s | 15.8% |

| 1990s | 14.6% |

| 2000s | 14.9% |

| 2010-2017(1) | 14.3% |

There was a jump in the investment share of almost two percentage points between the 1970s and 1980s, and then a falling back in the next three decades. The peak for the period was actually at the beginning of the 1980s, with the investment share hitting 17.9 percent of NNP at the end of 1981 and beginning of 1982. Its low point was 12.7 in 2010. The only time the investment share crossed 17.0 percent of GDP since the early 1980s was at the peak of the Internet boom in 2000 when it hit 17.1 percent. The trough in 2010 was clearly the fallout from the Great Recession.

Even with these extremes, we still only see a movement of 5.2 percentage points of NNP. If we look at longer period averages, the difference is only 1.9 percentage points between the 1970s and the peak in the 1980s.This means that if we are expecting investment to rise in order to make up the demand lost due to a large trade deficit or collapsing housing bubble, we are likely to be disappointed.

The other major point worth noting about the movement in investment shares over the last five decades is that it has little relationship to profit shares. The investment share peaks in the early 1980s when the profit share (both before- and after-tax) was near its low for this period. As noted, there is actually a weak negative relationship between the two. For this reason, it is not especially surprising that the investment share has not been higher in the years since the Great Recession, in spite of the high profit share.

Turning to profits, it is worth noting that the upturn in profit shares is a recent development. There was little clear evidence of an upturn in profit shares in the 1990s, which are mostly below the 1970s’ levels. There had already been a substantial increase in inequality in the 1980s and 1990s and this was almost entirely due to growing wage inequality, not a shift from wages to profits.

There is an upturn in the profit share in the housing bubble years, which resumed following a sharp downturn in the Great Recession. At least some of the profits in the bubble years are illusory. The profits on mortgages that subsequently went bad were booked when the mortgages were issued. The losses would depress profits in 2008 and later years when the holders no longer collect interest payments.[2]

The profit share did rise sharply after the Great Recession as wages did not keep pace with productivity in these years. This was likely due to the weakness of the labor market. In the last couple of years there has been some reduction in the profit share as the labor market has tightened. Whether the rise in profit shares will be fully reversed remains to be seen. Obviously part of the story will depend on the extent to which the Federal Reserve Board allows the labor market to tighten.

In short, it is not clear that there are any great mysteries about the movement of either investment or profit shares in recent years. Investment has not responded much to profit over this whole period, so it is not surprising that it is not doing so now. The high profit share in recent years appears to be in large part due to the weakness of the labor market following the Great Recession. If the labor market tightens sufficiently, we may see most or all of the increase reversed.

1 Corporate profits before and after tax cover domestic industries and include inventory valuation and capital consumption adjustments. Both series are obtained from the U.S. Bureau of Economic Analysis’s National Income and Production Accounts.

2 The profit share likely rose somewhat more than these data indicate over the last two decades since companies have increasingly found ways to have domestic profit show up at overseas facilities to reduce their U.S. corporate income tax liability.