July 01, 2013

Following up on last Wednesday’s item regarding downward revisions to gross domestic product (GDP) it is worth pointing out again that gross domestic income (GDI) is not a better measure of the economy. Though the two measures are in theory equal, each relies on different data sources and so the two differ by a “statistical discrepancy.”

As Dean and I noted previously, movements in the statistical discrepancy appear to be in part driven by misreported capital gains. Capital gains are not supposed to count toward GDI, which measures income with respect to production of current goods and services. However, it is likely that some amount of short-term capital gains are reported as ordinary income. (The IRS isn’t picky about such errors because it doesn’t really change taxes owed.) If a fixed percentage of capital gains is always misreported as ordinary income, then the absolute amount of misreporting will be larger when capital gains are larger. Thus, GDI becomes overstated and the statistical discrepancy–ordinarily positive—turns small or even negative.

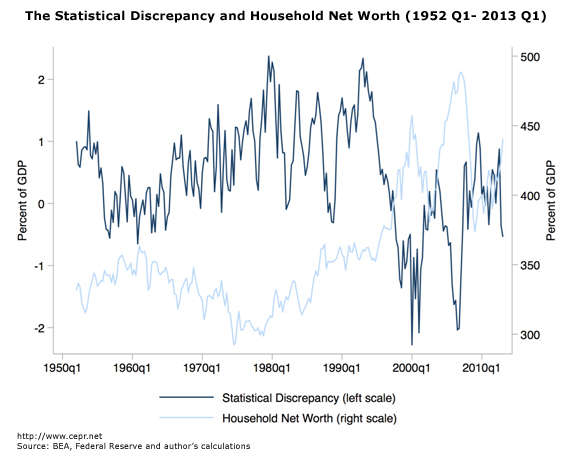

Previously, we used quarterly data from the Federal Reserve to show how household net worth varied with the statistical discrepancy—specifically that the discrepancy fell during periods of stock market and housing bubbles. This relationship is seen in the graph below.

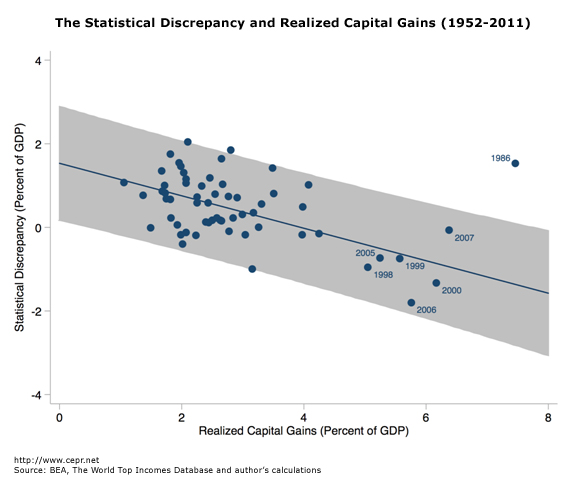

However, to impact GDI, households must realize the capital gains implied by these increases in net worth. Fortunately, the World Top Incomes Database reports annual capital gains realizations. Here is what the relationship looks like over the same period.

In this figure, the stock bubble years of 1998-2000 and the housing bubble years of 2005-07 show large realizations of capital gains and small-to-negative statistical discrepancies. 1986 stands out with particularly large realizations—the Tax Reform Act of that year increased the tax rate on capital gains to match that of ordinary income, giving people an incentive to cash in gains before the higher tax rates went into effect. This probably mattered more for filers used to reporting capital gains and so the realizations were more likely to be properly reported.

This is something to keep in mind the next time someone suggests the GDI numbers are more reliable.