December 09, 2010

Eighteen consecutive months. That’s how long unemployment has been over 10.5 percent.

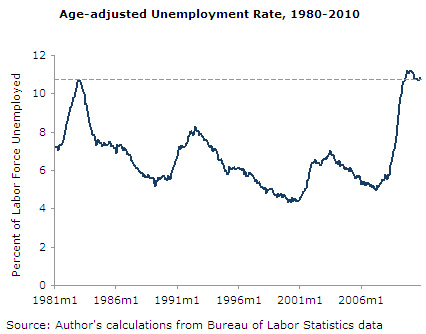

Officially, the worst spell of unemployment since the Great Depression came in 1982-83. Unemployment peaked in November and December of 1982 at a whopping 10.8 percent of the labor force. By contrast, the official rate of unemployment is only 9.8 percent, having peaked last October at 10.1.

So how can I say unemployment has been over 10.5 percent for a year and a half?

The official unemployment rate is a fine statistic as far as it goes. As unacceptable as 9.8 percent unemployment is on its face, it understates the historical depth of trouble in the labor market today. The U-6 alternative measure of unemployment is at 17.0 percent—more than 1 in 6 workers who have not completely dropped out of the labor force are unemployed or underemployed. Only 58.2 percent of the population age 16 and over are employed — the lowest rate of employment since the summer of 1983.

The historical unemployment rate masks changes in the composition of the labor force. Compared with the early 1980s, today’s labor force is older, more experienced and more educated. On the other hand, unemployment is always concentrated among the younger, less experienced, less educated population. Based purely on age, then, we would expect today’s unemployment rate to be lower than that of 1982-83.

By adjusting the data to hold constant over time the 1982-83 labor force, we can better see the historical depth of today’s unemployment. The age-adjusted unemployment crossed over 10 percent of the labor force in May 2009 and 10.5 percent in June. For eight months from September through April of 2010, the age-adjusted rate was at least 11 percent.

In every month for the last sixteen, age-adjusted unemployment has been higher than at any point in the 1982-83 downturn. This is an unmitigated disaster for millions of people. It is truly the worst spell since the Great Depression. The loss of income has been mind-bogglingly enormous — enough to buy 12.8 million homes – and has come on top of the loss of several trillions of dollars in housing wealth.

People need income, and if the private sector is going to wallow in record profits and sit on trillions in financial reserves, then the government has to step up. Elsewhere, job-sharing has helped keep unemployment low. Now is the time to make it happen here.