May 16, 2017

In March, the Federal Reserve Board voted to raise interest rates for the second time this year, indicating their concern that rising wages would result in inflation if they did not take action. However, an analysis of average hourly wage trends for six sectors of employment since 2010 finds little evidence that wages are rising dangerously fast, or even accelerating at all.

Average hourly wages for manufacturing jobs have seen a sizable increase in growth, from 1.6 percent to 2.5 percent. However, there is significant variance in this trend with wage growth near 0 percent in late 2012 and dipping down to 1 percent in 2014 and 2015. It has also stalled in recent months and there have been essentially no gains in manufacturing wage growth in the last year. Leisure and hospitality wage growth, although it more than doubled from 2.1 percent to 4.4 percent (most likely due to increased minimum wages in many cities and states), also varied wildly. Late 2010 included negative wage growth and there have been multiple peaks and troughs since then.

Wage growth in retail actually decreased modestly since 2010 despite two rapid increases. The growth broke 4 percent briefly in 2015 but has now dropped to 1.1 percent (compared to 1.2 percent growth seven years ago). Education and health services wage growth decreased the most out of any sector analyzed, from 2.5 percent in 2010 to 1.8 percent. This was not a steady decline, but since mid-2015 growth seems to have leveled off at around 2 percent.

Wages for professional and business services have had the steadiest increase in growth since 2010, from 1.6 to 3.5 percent. That steady acceleration is in spite of rapid changes from late 2011 to late 2012, and from 2014 to early 2017 wage growth which was arguably stable (between 2.5 and 3 percent). Construction wage growth has increased slightly from 2.3 percent in 2010 to 2.4 percent in 2017. Since this growth reached its low point in 2012 it has been increasing relatively regularly up to current levels.

Although there has been acceleration in wage growth since 2010 in certain sectors, it is important to note that since 2015 (when the Federal Reserve Board first decided to raise interest rates post-recession) there has been no significant trend in overall wage growth. Hospitality and manufacturing wage growth increased, retail and health wage growth decreased, and construction and professional wage growth was essentially flat.

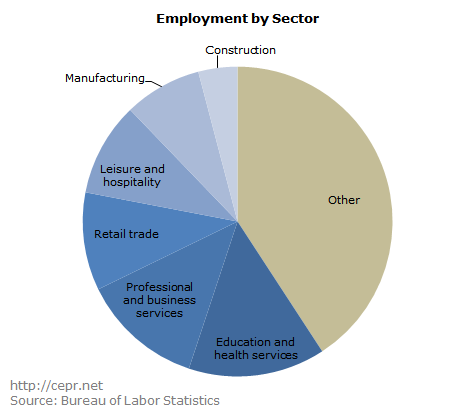

Even with some acceleration of growth, no single group of these employment sectors is large enough that its upward trend would sway the Board’s analysis. The rising wage group: hospitality, manufacturing, and professional services, employs barely more than half of the workers in the sectors analyzed and accounts for only 25 percent of overall employment. Similarly, the two sectors which have experienced rapid wage growth since the first rate hike are actually amongst the smallest employers of any of the sectors in this analysis. Given that the wage growth trend since 2010 is one of modest growth (at best), and that since the 2015 interest rate hike it has been completely ambiguous, there is little evidence of the inflationary pressures that the Federal Reserve Board cited when they chose to increase interest rates in March.