December 16, 2009

Prices Byte (December 16, 2009)

By David Rosnick

Higher energy prices push down real hourly wages.

Inflation rose 0.4 percent in November, driven by large increases in energy prices. Over the last quarter, consumer prices generally rose at a 3.4 percent annual rate, while core (non-food, non-energy) prices rose at a 1.5 percent annual rate.

The glut of housing has now resulted in a third consecutive month of price declines in both rent and owners’ equivalent rent. Neither series had ever shown price declines in two consecutive months since they were introduced in the early 1980s and have now fallen at a 1.0 percent rate over the last three months. Rent continues to hold down inflation; non-shelter prices rose at a 5.6 percent annualized rate since August.

The price of used cars and trucks rose 2.0 percent in November as a continued response to Cash-for-Clunkers’ impact on the supply of used vehicles. Over the last three months, used car prices have risen at a 31.5 percent annual rate.

Energy prices rose 4.1 percent in the month and at a 27.9 percent annualized rate over the last three months. These included a 6.0 percent jump in (seasonally-adjusted) fuel oil prices, which have now grown at a 74.4 percent annualized rate over the last quarter.

The November price report continues to show the pressures on state and local budgets. Tobacco prices rose another 1.0 percent in the month and nearly 10 percent annualized over the last three. Public transportation prices rose 2.6 percent in November—the 25 percent annual rate of increase over the quarter in part reflecting higher fuel prices.

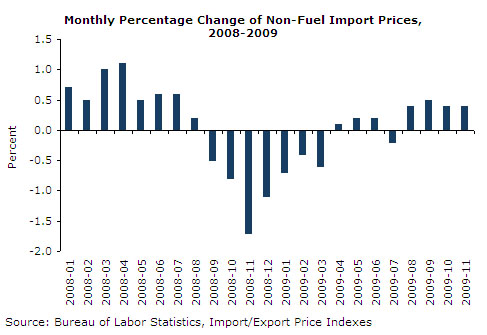

Non-fuel import prices rose 0.4 percent in November after similar changes in the prior three months. The 4.9 percent annualized rate of inflation in non-fuel imports over the last four months follows a 0.8 percent rate over the prior four months, and an 8.2 percent rate of decline from November of 2008 to March of 2009. The rise in import prices in the second half of the year tracks the 12.7 percent fall in the real dollar since the peak in March.

Nonagricultural export prices jumped 0.7 percent in November. The 1.0 percent rise over the last three months is up—the 3.9 percent annualized increase compares to 3.0 percent over the six months from February to August—but is likely to be reversed in part over the coming months.

The producer price index for core finished goods rose 0.5 percent in November, largely reversing the 0.6 percent fall in October. The core intermediate goods index rose 0.3 percent, and 1.4 percent overall. This is a more consistent story than reported last month, affirming that October’s mixed signals were likely the result of erratic data.

Finally, the average real hourly wage fell $0.04 in November and now stands $0.01 below its level one year ago. The continued decline in wages amidst falls in employment bodes ill for the prospects of a consumption-driven economic recovery.

David Rosnick is an economist at the Center for Economic and Policy Research in Washington, D.C. He received his Ph.D. in Computer Science from North Carolina State University and his M.A. in Economics from George Washington University. CEPR’s Prices Byte is published each month upon release of the Bureau of Labor Statistics’ reports on the consumer price and the producer price indexes. For more information or to subscribe by email, contact CEPR at 202-293-5380 ext. 102 or email [email protected].