September 14, 2016

On January 25, 2012, the Federal Reserve (“Fed”) announced that it would target an inflation rate of 2.0 percent per year. In its press release, the Fed stated:

“The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee judges that inflation at the rate of 2 percent…is most consistent over the longer run with the Federal Reserve’s statutory mandate.”

In public debates, this statement has frequently been misinterpreted in at least two ways. The first relates to treating 2.0 percent as a ceiling rather than a target; the second relates to the timeframe over which the target is supposed to be achieved.

With respect to the first issue: because 2.0 percent is a target, the Fed should find 1.0 percent inflation just as problematic as 3.0 percent inflation. However, some members of the Fed have been treating 2.0 percent more like a ceiling than a middle-of-the-road target. About two weeks ago, Vice Chairman of the Fed Stanley Fischer praised the U.S. economy partially on the basis that inflation was “within hailing distance” of the Fed’s target. Other members of the Fed have made similar statements.

A second error is to treat the 2.0 percent target as a purely short-term goal. The Fed says that it “implements monetary policy to help maintain an inflation rate of 2.0 percent over the medium term” (emphasis added). This means that the Fed should actually try to overshoot its target rate following a period of below-target inflation; for example, a period of 1.5 percent inflation would be offset by a period of 2.5 percent inflation so as to achieve a medium-term average of 2.0 percent.

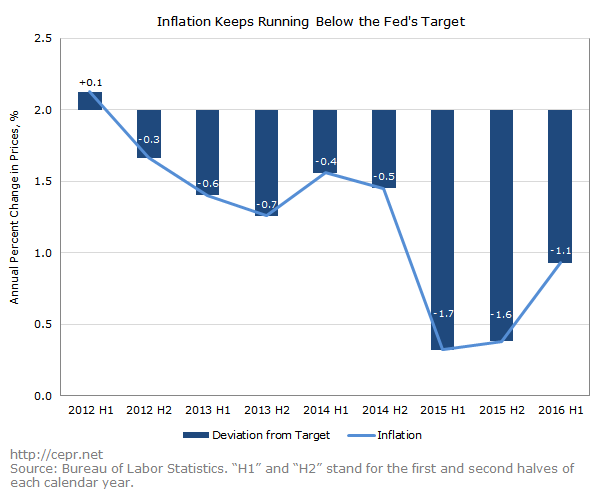

Unfortunately, the Fed has never fully specified what it means by “the medium term.” However, it’s clear that no matter how “the medium term” is defined, the central bank has been undershooting its target. Since the Fed’s announcement in January 2012, inflation has been below 2.0 percent 51 out of 54 months. Prices have risen just 5.1 percent over the past 4.5 years; with 2.0 percent inflation, they would have risen 9.3 percent. The figure below shows that since the Fed first announced its target, inflation has consistently run below 2.0 percent.

The Fed could actually use this fact to its advantage. One of the Fed’s most powerful tools for fighting unemployment is “forward guidance” — the idea that the Fed can push down long-term interest rates by signaling its intention to keep short-term interest rates low. Paul Krugman, in his summary of a paper by Columbia University economist Mike Woodford, explained how this can be useful when the Fed is trying to pull the economy out of a depression:

“…the central bank can still gain traction if it can convince the public that it will pursue a more inflationary policy than previously expected after the economy recovers. As I wrote way back then, the central bank needs to credibly promise to be irresponsible.

“But can it really do this? Woodford devotes the first half of the paper to an extended review of the evidence on ‘forward guidance’, in which central banks signal their future intentions — and finds strong evidence that such talk matters. So his answer is yes, the Fed could boost the economy by making a commitment to hold off on raising interest rates when recovery finally kicks in.”

If the Fed announced that it would allow inflation to exceed 2.0 percent for the next few years, investors would anticipate that the Fed will keep short-term rates low for the foreseeable future; this, in turn, would push down long-term interest rates. The same result could of course be achieved through a higher inflation target or nominal GDP targeting — but the Fed has been reluctant to abandon its 2.0 percent target. If the Fed wants to boost the labor market while keeping its current inflation target, it will have to begin signaling its desire for over 2.0 percent inflation in the near future; that is, it will have to start treating 2.0 percent as a long-term average rather than a short-term ceiling.