March 16, 2016

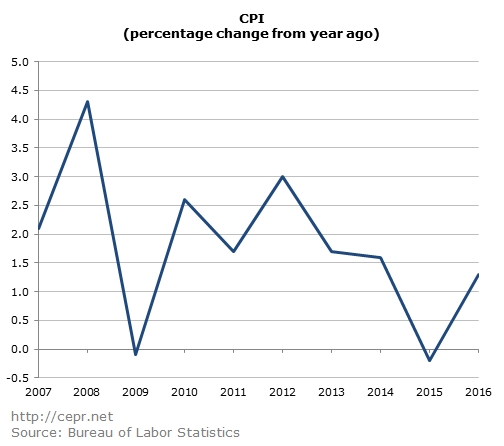

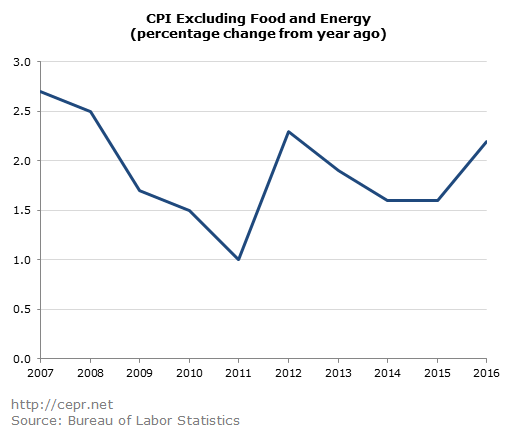

Recent CPI data could give the impression that overall inflation is being held down by falling energy prices. While energy prices have fallen by 12.5 percent over the last year, the core inflation rate, which excludes food and energy prices, has risen by 2.3 percent. (The Federal Reserve Board actually targets the core Personal Consumption Expenditure Deflator, which has increased by 1.7 percent over the last year.)

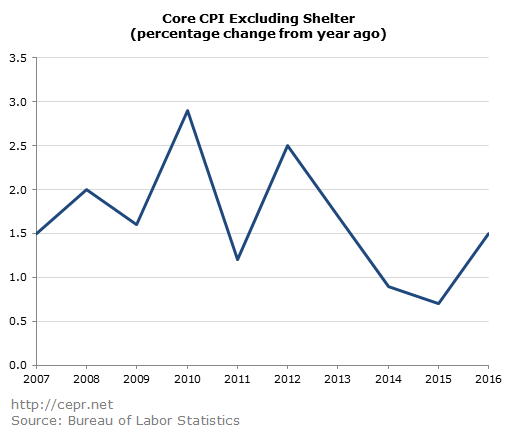

However, it turns out that much of the inflation in the core index is driven by the shelter component as rents have been rising at more than a 3.0 percent annual rate. Excluding the shelter component, the core index is rising at just a 1.5 percent rate. While there has been some increase in this non-shelter core index in recent months, that was also true in 2001, when the economy and labor market were still quite weak by any measure.

Furthermore, a rise in interest rates would make things worse in the housing market by slowing housing construction. This would put further upward pressure on housing costs.