March 11, 2013

I wrote back in December about how the shift to a “chained” CPI would have negative impacts that go far beyond Social Security. On March 1, the Congressional Budget Office released a new estimate that helps quantify these impacts.

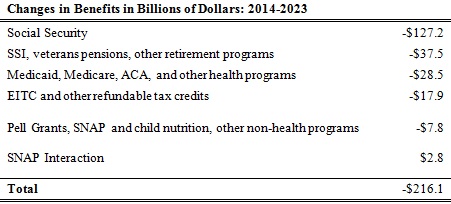

The table below shows the amount of benefit cuts that would result over the next 10 years from switching to the chained CPI. The table is limited to “mandatory” programs and the tax code. CBO assumes that shifting to a chained CPI would reduce annual adjustments to mandatory programs by .25 percent per year.

An important thing to remember about the chained CPI is that it is a cut that keeps on growing. In the first year, reducing inflation adjustments by .25 percent results in a .25 percent cut; but in the 10th year, it means a 2.5 percent cut. So, for example, as the CBO estimate shows, the cuts to the EITC and other refundable tax credits are $300 million in 2015, but grow to $3.7 billion in 2023.

Proponents of the chained CPI assume that it is a more accurate measure of inflation, including for the elderly and for low- and moderate-income people, because it better captures opportunities that people may have to respond to price increases by substituting to goods whose prices are rising more slowing. But the elderly and low-income people have more limited consumption baskets than higher-income people and don’t necessarily have the ability to substitute. As Dean Baker and many others have pointed out, the Bureau of Labor Statistics has an experimental elderly price index that shows the inflation rate experienced by the elderly has risen faster than the current CPI. (Dean participated in a recent Hill briefing on the changes involved with tying COLAs to a chained CPI.)

BLS has also conducted research on inflation rates for low-income people. Although this research, published in 1996, is somewhat dated, it suggests that there is very little to no substitution bias in the current CPI for low-income people receiving Supplemental Security Income or various other forms of public assistance. In other words, that they are not able to substitute in response to price changes in the way assumed by the chained CPI. (Specifically, BLS found that substitution bias was equal to 1.99% between 1984-1994 for all consumers, but only .25% for low-income program participants.) The BLS research isn’t conclusive, but it’s the best thing we have to date.

Click for larger version

Finally, some proponents of switching to the chained CPI have argued that we can address the harmful impacts by exempting certain means-tested programs (like SSI) and boosting benefits at the bottom in Social Security and other contributory programs. But a deal that reduces Social Security benefits for moderate-income seniors, who already have good reasons to think that their benefits aren’t keeping pace with the costs of basics, while increasing benefits for low-income ones, is not a good deal for those who have Social Security’s long-term interests at heart. We certainly need to improve Social Security for poorly compensated workers, but there are better ways to finance such improvements.