July 14, 2011

July 14, 2011 (Latin America Data Byte)

By Rebecca Ray

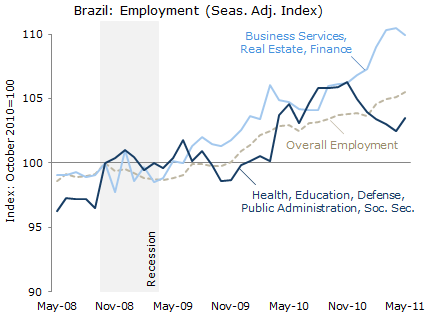

The only major employment sector to out-perform the overall job market since the recession is business services, real estate, and finance.

Brazil’s employment situation in May shows falling unemployment but also falling earningsm. More working-age Brazilians are employed than ever before, as the employment-to-population ratio hit a new high of 53.9 percent,. With regard to measures of underemployment, there are fewer than ever employed informally, or for fewer hours than they would prefer, or earning less than the minimum wage. However, median earnings fell in both the public and private sectors, and among the self-employed.

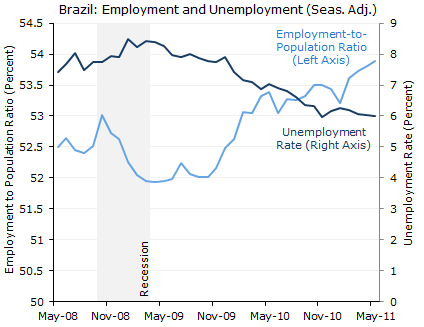

Employment and Unemployment

In May, Brazil’s unemployment rate fell to a seasonally-adjusted 6.0 percent, matching its November 2010 level, the lowest since records began in 2002. The employment-to-population ratio rose to 53.9 percent, the highest on record.

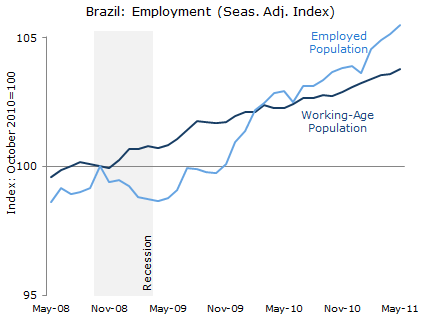

Both of these indicators have long since recuperated from the recession, during which the unemployment rate rose to 8.5 percent and the employment-to-population ratio fell to 51.9. The latter reached its pre-recession peak in February 2010, and has continued to rise, as employment has grown faster than the working age population.

Employment by Sector

By sector, the fastest-growing area of employment since the recession has been business services, real estate, and finance. After dipping only briefly during the recession, employment in this sector grew more quickly than the overall job market for most of the recovery. In May it fell for the first time since June 2010, shedding approximately 18,000 jobs, but it is still 9.9 percent above its pre-recession level, showing twice the level of growth of the overall job market. The worst-performing sector in the recovery has been the one including health, education, defense, public administration, and social security. This sector had been outperforming the job market as a whole until November 2010, when the number of jobs in the sector rapidly lost most of its prior gains. From November 2010 through April 2011, the sector lost about 140,000 jobs, about 4% of its total. In May it grew by about 34,000 jobs, but it is still only 3.5 percent above its pre-recession level.

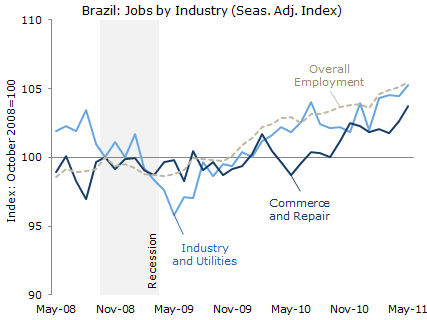

The other two major sectors, industry and utilities, and commerce and repair, have both underperformed the overall job market for most of the post-recession period. Industry and utilities fell the most from 2008 to 2009, but has now recovered to 5.3 percent above its pre-recession peak, about the same level as overall employment. Commerce and repair has not fared quite as well: it gained 45,000 jobs in May, putting it about 3.7 percent above its pre-recession peak.

Job Quality and Pay

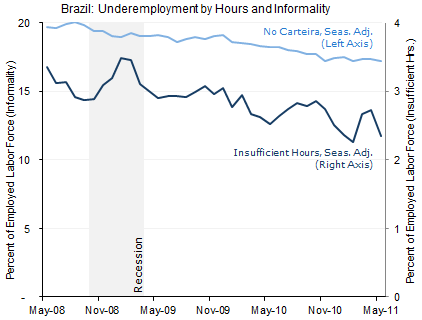

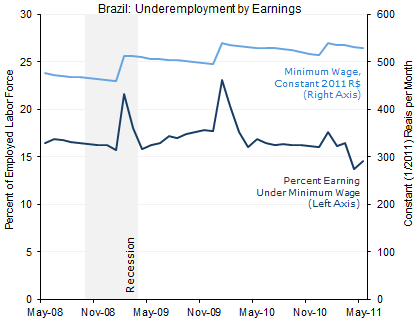

The IBGE publishes data on three types of underemployment: working fewer hours than desired, informal work (defined here as working without a carteira that would make the worker eligible for social security benefits), and earning less than the equivalent of full-time minimum wage. The first two measures declined in May, and the third rose. Underemployment by both hours and by informality declined enough to approximately meet the record lows set a few months ago. The percent of workers reporting insufficient hours fell to 2.3 percent, approximately matching the low set in February, and informality fell to 17.3 percent, meeting the record low set in November 2010.

Underemployment by pay (defined as earning less than the equivalent of full-time minimum wage) spikes each time the minimum wage rises. In January 2011 it had a much smaller spike than in previous years. This may be due in part to the fact that the minimum wage had the smallest raise in a decade: it rose by only 5%, less than the rate of inflation. Since then, the percent of the workforce earning less than the minimum wage has fallen, and was 14.6 percent in May. The last time it was below 15 percent was 2005, when the minimum wage was worth about two-thirds of its current value.

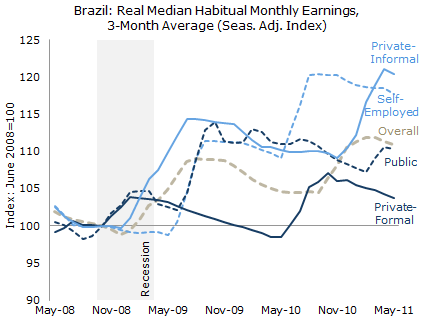

Real median habitual earnings fell in both the public and private sectors, and among the self-employed. Overall, monthly earnings fell in May for the fourth consecutive month. Over the last three months, they’ve fallen at an annualized rate of 4.3 percent. However, they rose sharply last fall, and are currently 11.1 percent above their October 2008 level, an average of 4.2 percent real growth per year.

May’s decline in monthly earnings was most pronounced in the public sector, where median earnings fell from R$1,598 to R$1,515 per month. This fall comes after a period of decline punctuated by a spike in March 2011, so earnings are only slightly below where there were three months ago: R$1,529 per month. Since the beginning of the recession, they have grown 3.2 percent, an average rate of 1.2 percent per year.

Private sector earnings have seen widely divergent trends paths between formal and informal sector workers. Informal workers saw monthly earnings fall by twice as much in May as formal workers, but since the beginning of the recession, informal workers have seen higher overall earnings growth than their formal counterparts. Formal sector workers’ earnings fell from R$908 to R$903 per month in May, while informal workers’ earnings fell from R$698 to R$691. Still, formal workers’ earnings are only 3.4 percent above their pre-recession levels, yielding an average growth rate of 1.3 percent per year. Meanwhile, informal workers’ earnings have risen by nearly one-fifth (19.7 percent) since October 2008, or an average rate of 7.2 percent per year.

Finally, self-employed workers’ median habitual earnings fell from R$813 to R$803 per month in May. They are currently 17 percent above their October 2010 level, giving an average growth rate of 6.3 percent per year since the recession. Their monthly earnings have been trending downward since September 2010, when they rose to R$832 per month, 21 percent above their pre-recession level.

Overall, Brazil’s employment picture in May is consistent with the strong real and the growth of the finance sector: the only major employment sector with more growth than the overall job market since the recession is business services, real estate, and finance.